The Most Innovative Electric Rate Died Before It Started

An obituary for the Transactive Energy Rate

Last week, we talked about “spot price anarchy,” a ideological future for the electric grid that centered on letting real-time markets run wild with energy costs—the idea being that such an arrangement would solidify the business model for solar-storage systems and semi-grid-tied microgrids at the specific expense of traditional electric utilities.

Near the end of that post, I noted that New England has seen a retail electric rate that is, in DER Holy Warrior Duncan Campbell’s words, “purely cost-reflective.” It was a pilot rate instituted in 2023 by New Hampshire Electric Coöperative called the Transactive Energy Rate (TER).

And it was pretty freaking sweet.

The Man Behind the Plan

The Transactive Energy Rate was the brainchild of a Brian Callnan. His LinkedIn suggests a career very similar to mine. He started as a utility resource planner—which is what I do—working up the ranks in public power, neck deep in ISO-NE filings, renewable energy technologies, and long-shot forecasts. And he managed to reach a Director-level position at the Vermont Public Power Supply Authority (VPPSA) by his mid-thirties!

From VPPSA, he joined NHEC do to similar power supply work. From Campbell’s perspective, this is guy most qualified to write a purely cost-reflective rate, specifically because power supply analysts track and manage the majority of a utility’s cost structure.

And in 2023, Callnan broke out the trumpets for a cool new electric rate, piloted in collaboration with a utility software company called Bellawatt.

A New Use for Electric Cars

A slide deck presented for the Institute for Local Self-Reliance leads with a 2020 quote by some Volkswagen exec:

By 2025 we will have 350 gigawatt hours worth of energy storage at our disposal through our electric car fleet. Between 2025 and 2030 this will grow to 1 terawatt hours worth of storage. That’s more energy than is currently generated by all the hydroelectric power stations in the world. We can guarantee that energy will be used and stored and this will be a new area of business.

Did this happen? Probably not. But it’s the single largest promise electric vehicles pose to grid analysts like me. Normally, grid-scale batteries are this expensive asset that requires immense sums of capex that we don’t have. But back in 2019, it seemed like electric vehicles were really taking off! And if people were going to buy grid-connected, internet-connected lithium battery in 70-100kWh increments, would it not make sense to utilize those resources instead? Instead of paying upfront to install and depreciate a MW-scale battery, utilities could pay credits to use people’s cars—at a discount, even, because regular consumers don’t know about depreciation and won’t notice their car batteries wear out from grid-motivated power cycling until it’s too late.

The problem is that car manufacturers, electric utilities, and electric utility vendors are are god-awful at writing, maintaining, and using software tools. The standard approach is to use a distributed energy resource management system (DERMS) to mediate the handshake between grid analyst and electric vehicle, usually through some dangly list of API calls, usually for an exorbitant fee to the electric utility, usually for some pathetic cookie of an incentive to the customer. The control signal is almost always manual, too—the utility must forecast a high-cost peak time, press the SHED LOAD button, and give all the relevant loads 8-24 hours of notice to react or refuse.

The Transactive Energy Rate, by contrast, doesn’t bother with API links or manual dispatch. Instead, the rate is built on custom software that downloads an hourly electric price curve, beams it direct to electric vehicle chargers, and lets those chargers do the math on the most optimal charging schedule for the next day.

There’s a lot going on—let’s go step by step, starting with the software vendor: Bellawatt.

A New Kind of Electric Software

Bellawatt does not sell you a product—they sell you the service of custom-baked software. The “products” listed on their website are actually case studies: an electrification marketplace for PG&E, a sales platform for Scale Microgrids (hey, that name sounds familiar!), and the Transactive Energy Rate for NHEC.

They’re the kind of company that will barge into a request for proposals (RFP) for some anodyne utility software with a, “We don’t have a specific product for you, but we can build you a to-spec software in six months!” From a 30,000-foot view, this feels very Palantir, in that the core business model is, “We’re here to solve your problem, not to sell you a specific software.” The tradeoff is that you lose economies of scale. You’re also beholden to that company, because a Bellawatt software system is not modular and cannot be hot-swapped like, say, generic customer information systems (CIS) or meter fleets. In practice, swapping between those generic vendors still takes two years and ruinous invoices, so Bellawatt’s buy-in isn’t egregious.

And on the flipside, you get to work with modern software engineers, instead of the bumbling rubes at Itron, Sprypoint, Oracle, and so on. The case study looks pretty rosy on Bellawatt’s webpage, and it helpfully obscures the fact that as of 1 April 2025, you can’t sign up for the Transactive Energy Rate..

A New Formula for Power Supply Charges

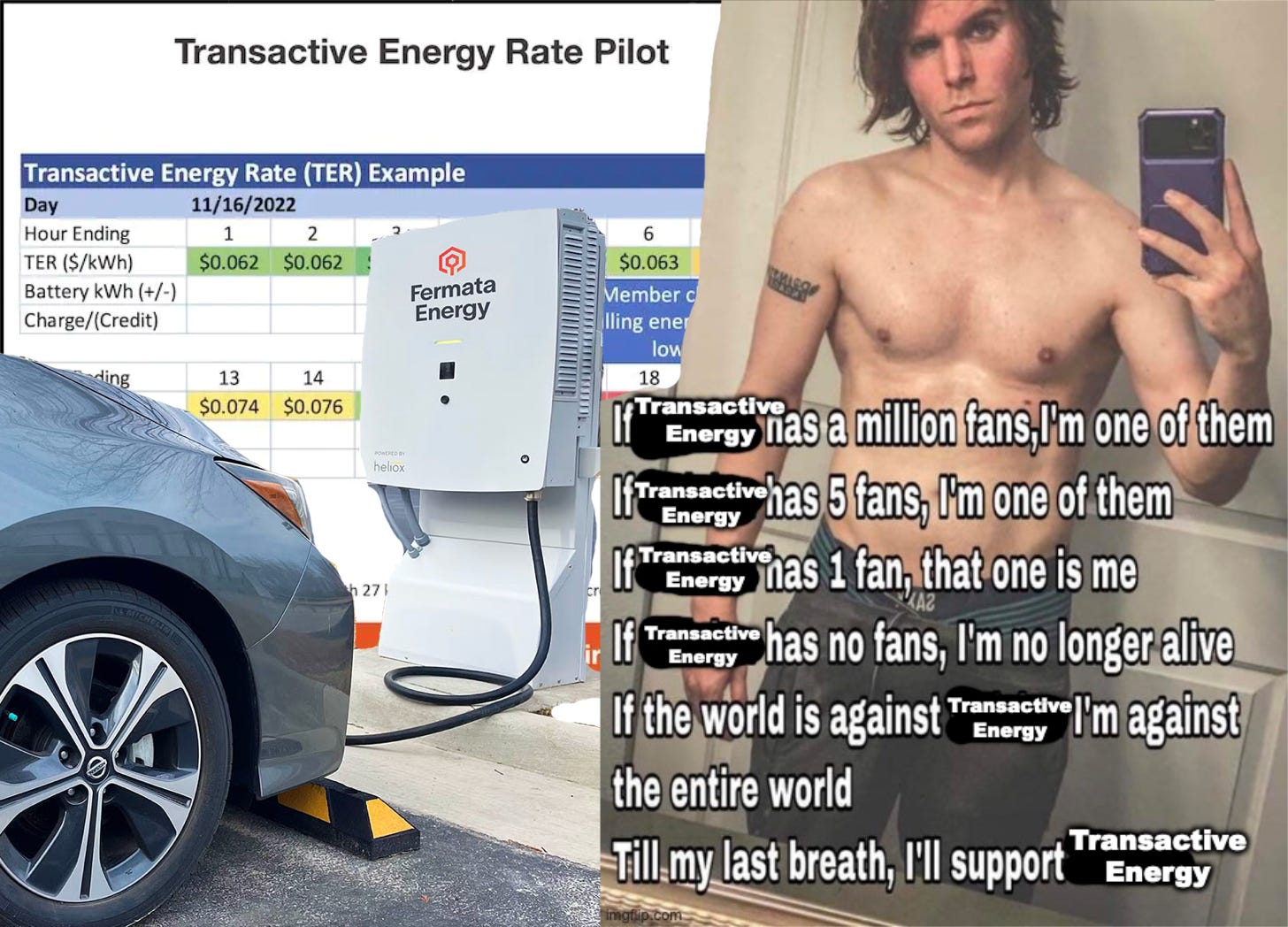

The Transactive Energy Rate was in development from 2020 to 2022, launching Q1 2023. Customers signed up by linking distributed energy resources (DERs) like:

Home batteries

Only Generac PWRcell batteries eligible

Standard electric vehicle chargers

Only Chevy Bolts and Volts eligible

Chevy Silverados and Ford F-150 Lightnings incoming

Two-way vehicle-to-grid (V2G) electric vehicle chargers

Only Nissan Leafs with compatible Fermata Energy chargers eligible

Solar and solar-storage systems

The core structure was that:

NHEC would generate a “day-ahead” price curve for the coming day, based on day-ahead price curves settled at the ISO-NE wholesale energy market and a prediction of monthly transmission peaks. This price-setting tool was built in-house, not by Bellawatt.

That day-ahead price curve would get sent to compatible DERs via a Bellawatt-written OpenADR tunnel

Those DERs would adjust charging and discharging patterns to minimize net cost to the customer

Those DERs would beam back telemetry via the same OpenADR tunnel

Those DERs would be metered separately from the rest of the house based on a vector-multipled power supply charge

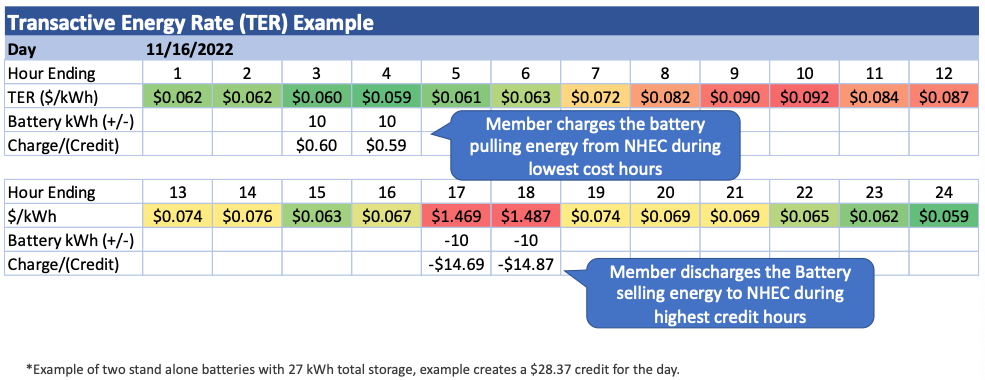

It’s easier to explain with a table:

In this example, we’re looking at a home battery—it charges low (2 AM-4 AM) and discharges high (4 PM-6 PM). The next bill the customer sees for their battery’s power supply charge would have a vector dot product, each hour’s energy use multiplied by that hour’s electric rate:

In the above example, that formula would look like:

With this software stack, you could truly get a real-time electric rate, which allowed compatible distributed energy resources to do real automated energy arbitrage. Standard electric vehicles were projected to see annual savings of $1,800, V2G electric vehicles annual savings of $3,350, and home batteries annual credits of $1,200. Those are solid savings numbers for electric vehicles, and pretty much break-even credits for the battery…assuming a near-zero discount rate.

The core challenge was compatibility. At the time of the 2023 rollout, only the Nissan Leaf could handle bidirectional power flow, and even then only with a dedicated charger by a company that nearly died and got acquired by a competitor for less than the price of a single new Ferrari SF90. Tesla PowerWalls and electric vehicles weren’t eligible, probably because Tesla wouldn’t pick up the phone for a piddly 500-customer pilot program that they couldn’t commandeer for themselves.

But that was fixable with time and further development. I remember hearing about this rate as it was being piloted. I asked Callnan himself for a PDF of the sample bill. I wanted to adapt its core technology for my employer.

What wasn’t fixable was Callnan’s departure from NHEC.

A Classic Death of a Good Idea

Callnan had good reason to leave NHEC: he was offered the CEO seat at the Community Power Coalition of New Hampshire (CPCNH). This organization is a power supply aggregator, a dedicated energy trader that supplants the default power supply provided by existing New Hampshire utilities, for anyone that signs up to their plan. CPCNH is the kind of organization spot price anarchists like Campbell would advocate for—additional customer choice, room for innovation in power supply, a focus on developing local energy resources. This is notionally good for New Hampshire customers—particular customers that want to pay for renewable energy.

But for the world’s Transactive Energy fan, this was a heartbreaking death knell for a program I wanted to steal for my own purposes. Without Callnan, the pilot lost its champion, and it sunk out of use. Bellawatt probably still has the code, but someone would have to ask them to revive it. And who—besides Brian Callnan and me—remembers this rate? Would they not start from the same piddly pilot scale, but now in a worse economy with deeper skepticism about electric vehicles?

The Lesson: Is Leadership On Board?

More recently, I heard another account of why the Transactive Energy Rate died—new management. Late into the rate’s multi-year development, NHEC got a new CEO. I know very little about this new figure, but I did hear “not interested in new ideas.” For such a leader, a first-in-the-country-type idea like the Transactive Energy Rate must sound like a waste of budget and effort.

“Who asked for this?“

“Will customers even like this?”

“It looks slapped together! Why do this when we can do something that works?”

This kind of leadership does not automatically kill innovative projects. But it does threaten budgets, slow-walk approvals, and prevent project managers from driving to conferences to share their notes. And speaking from experience, learning your boss thinks your labor of love is a waste tends to sour your motivation. It makes you seek new employment.

For outside companies, this poses a core challenge for working with electric utilities. To make a novel project work, you need:

An engaged project manager to champion the project

A upper leadership that at least is amenable to the project

…for at least three years.

If the champion isn’t available, the utility does nothing. If the leadership doesn’t care about the project, it will stagnate in procurement or regulatory approval while the champion harangues their boss to look at the contract that’s been sitting in limbo for three months. And if the champion gets a new job, or the leadership above them changes, the project has a strong chance of collapsing right there.

This makes startups understandably skittish to work with electric utilities. I think it’s also why so many energy startups instead see utilities as an enemy to circumvent. I think the DER Task Force can attest to that.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not reflect those of their current or previous employers or any elected officials. The author makes no recommendations toward any electric utility, regulatory body, or other organization. While certain information contained herein has been obtained from sources believed to be reliable, the author has not independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author assumes no liability for this information and no obligation to update the information or analysis contained herein in the future.

This kinda sounds like when we talked about VPPs