2025 Energy Predictions: Quant Edition

TL;DR: Hedge, now.

Happy new year, folks.

I’ve joined the Defense Analyses Research Corporation (DARC) as a senior fellow. DARC is a defense think tank startup attempting a ground-up rethink of national strategy. Think Tech Right meets Jennifer Pahlka meets Palmer Luckey’s NERV jacket. My first piece for DARC is here.

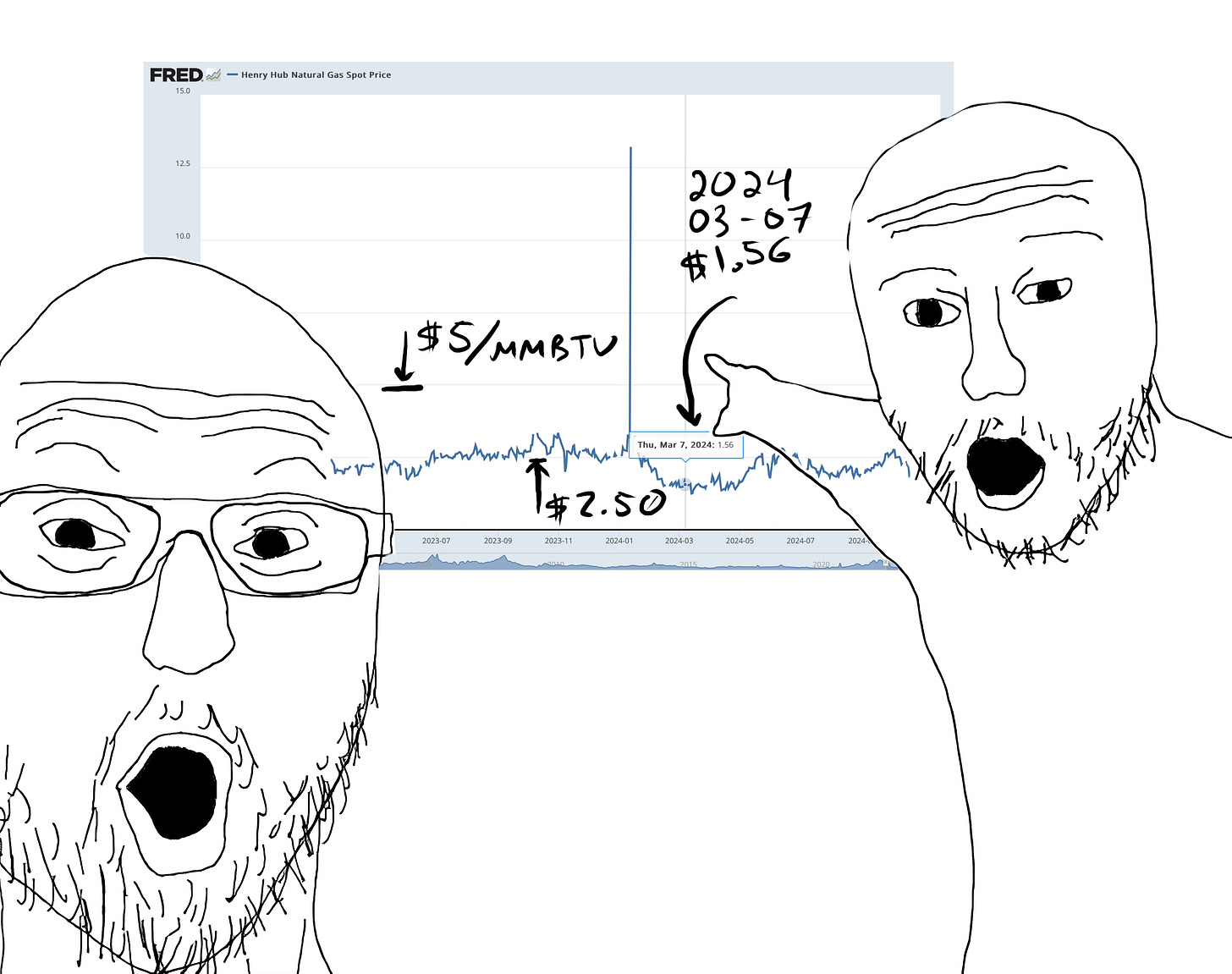

Now that I’m a public-facing analyst, I want to partake in the requisite hubristic predictions of What Will Happen In 2025. To that end, I’ll hold myself to some standards—the Intelligence Community Directive 203’s Analytic Standards. In particular, I will only make predictions I have high confidence on, and I will frame likelihoods based on the below scale.

…And for entertainment purposes, I’ll grade my performance in January 2026.

Fossil Fuels: Drill for Whom?

We know President Donald Trump wants to drill for more oil and gas. The term of art is “energy dominance,” but the promise is that Trump will cut energy prices in half.

Cute.

The problem is that North American oil and gas markets are already saturated and supersaturated, respectively. The current $70/bbl price for West Texas Intermediate (WTI) crude oil1 seems high, but that’s $50/bbl in 2008 dollars. OPEC+ tried increasing oil prices in 2023 by cutting production twice. And by the end of 2024, they haven’t unwound either cut. The current price of oil is well below Saudi break-even prices,2 which is no doubt keeping Crown Prince Mohammed bin Salman up at night.3 Even among American shale producers, the current price of oil is dangerously close to break-even rates. Opening up new land for drilling likely will not increase production, because that extra oil is unlikely to turn a profit. The only way that the Trump Administration could crater oil prices is to mandate uneconomic drilling, forcing an oil glut that will bankrupt local producers unless the federal government hands them money to stay solvent.

There is a remote chance that the price of oil goes up, though. Israel could bomb Iran’s largest (only) oil export terminal, now that they have severely degraded Iran’s air defense. Or, some country might make a move on Russia’s “shadow fleet”4 of oil export tankers. Some countries around the Baltic Sea are making tepid efforts toward this end,5 but none have entertained kinetic responses. These are long-shot (and arguably reckless) military actions, but they would be straightforward moves on obvious enemies. They’re concerningly possible.

The situation on natural gas is even more extreme. I’ve been sending incredulous screenshots of the Henry Hub spot price to colleagues, because the price of natural gas is so low as to be funny. Autumn 2024 natural gas prices ($1.70-2.00/MMBTU) were in the 2nd-8th percentile of historic gas prices since 1997, in part because shale oil wells produce so much “extra” natural gas that it’s often more cost-effective to flare the methane at the top instead of collecting and selling it. Compare that price to the European and Asian liquified natural gas (LNG) prices during the same time. Since 2023-Q2, the price of LNG has stabilized to $10-14/MMBTU in Europe and $10-15/MMBTU in Asia, down from 2022 prices that can only be described by a dolly zoom.

We’re seeing glut pricing for American natural gas. It can’t get any cheaper short of being honest-to-God free. But it can easily get more expensive: just increase LNG exports, because every MMBTU of natural gas makes astronomically more money abroad than it does in the American market.6 The more LNG the United States exports, the more the domestic market is exposed to the international market. And yes, Trump wants to export more LNG.

This means Trump’s plans to promote American energy dominance are at risk of increasing energy prices. I don’t think any new LNG terminals will open in 2025. But when they do open in a few years, I suspect we’ll see natural gas prices tick up a bit.

[EDIT 2025-01-13: Turns out a new terminal (Plaquemines) and a terminal expansion (Corpus Christi Stage 3) started liquefying gas December 2024. This is 5-6 extra Bcf/d of capacity on top of an existing 10-11 Bcf/day of American LNG export capacity.]

Renewable Energy: God Help Us

I couldn’t find good numbers on how much of the world’s transformers and grain-oriented electrical steel is made in China. But I can say for sure that China dominates photovoltaic panel manufacturing at every step of the supply chain, not to mention wind turbine manufacturing, and supply and demand for lithium batteries. And more than that, China leads the world in production of pig iron, crude steel, and continuously-cast steel by 1-2 orders of magnitude beyond whatever country is second place.

You know tariffs are coming. Trump wants it, the general public wants it, Congress is ready to pass some, and those tariffs will directly hit the renewable energy technologies that utilities are relying on for decarbonization targets.

Consulting shop Lazard made some levelized-cost-of-energy estimates for renewables in June 2024. Their assumptions pass my gut check. If you don’t care about when your electricity shows up,7 Lazard reckons onshore wind and utility-scale solar are cost-competitive with gas, at $50-60ish/MWh, which converts to $60-80/MWh PPAs in New England. Offshore will likely cost more. Tariffs could add 20-30% to these prices, inflation could add another 5-10%, and I’ll let you price in the cost of an extra year of lead time.

Protect your quotes for solar, wind, and storage. There are only upside price risks in the short term.

Capital: The New Normal

Let’s run through Trump 2.0’s favored policies:

Pass tax cuts: At minimum extending the 2017 Tax Cuts and Jobs Act, and likely more tax cuts beyond that. At best, this keeps the US deficit high. At worse, this increases the deficit dramatically, while also pushing spending money into people’s hands. This is inflationary.

Set tariffs: These could be anywhere from 10-100% depending on the thing and country of origin. (The specific tariff amounts depend on dealmaking I will never witness.) This is maybe inflationary. It will raise prices in the short term but potentially strengthen the dollar in the process, limiting the price increase. However, in the long term this could…

Devalue the US Dollar: I don’t even know how the Trump Administration would do this, but they seem to have ideas. This is inflationary, because it would 1) make all imports more expensive and 2) incentivize companies to sell products to export markets instead of the home market, reducing supply in the US and thus raising prices.

Boost industrial development: This is the apparent end goal for Trump 2.0, but it’s already happening. Continuing this trend is inflationary, because it means a lot of companies borrowing money to spend it on steel and concrete and labor and construction contracts, and thus bidding up those prices to compete with everyone else borrowing and spending, and thus passing those increased costs to their customers.

That’s a lot of inflationary pressure! It will compel Federal Reserve Chair Jerome Powell (whose term ends March 2026) to raise interest rates in response. He’s spent the Biden lame duck period cutting rates, but I suspect the New Year’s effective rate of 425-450 bps is a floor for 2025. Don’t cry: the Federal funds rate in the late ‘90s was 5-6%. The late ‘80s rate was 6-10%. No matter your age, the time period you’re nostalgic for had higher interest rates than today. We’re all spoiled on post-2008 free money.

Predictions

ALMOST CERTAIN (95-99%)

The dry natural gas daily spot price measured at the Henry Hub will not fall below $1.60/MMBTU during 2025.

HIGHLY PROBABLE (80-95%)

✅ The Trump Administration will attempt to increase production through executive action. UPDATE 2025-04-08: Note I said attempted, not succeeded.

Annual oil and natural gas production in 2025 (as reported to the EIA) will be flat-to-negative (-20% to +10%) versus 2024.

🚫 The WTI crude daily spot price measured at the Cushing, OK hub will not fall below $65/bbl during 2025. UPDATE 2025-04-08: Did not expect tariff fears to crater oil prices.

🚫 Trump Administration tariffs and the attendant supply chain shifts will increase the 2025 per-kW price of solar photovoltaic panels, wind turbines, and lithium-based battery energy storage by 20-50% relative to 2024 prices. UPDATE 2025-06-17: Per Lazard’s LCOE+ 2025 report, utility solar capital costs fell 13-26%, offshore wind costs rose shifted -12% to 9% (the cost range narrowed at both ends for 2025), and the cost of a 100 MW / 400 MWh utility storage system rose 8-36%. Manufacturing and mineral prices fell, confounding my prediction that tariffs and trade wars would increase prices.

✅ At least some New England solar and/or wind RFP responses in 2025 will exceed $100/MWh. UPDATE 2025-07-03: It’s here. Confidential emails, but it’s here.

The Federal Funds Effective Rate will not fall below 4% in 2025.

ROUGHLY EVEN (45-55%)

At least one of Ocean Winds NA (SouthCoast Wind), Avangrid Renewables (NE Wind 1), or Avangrid/Copenhagen Infrastructure (Vineyard Wind 2) will back out of their offshore wind agreement, citing equipment price increases.

HIGHLY IMPROBABLE (5-20%)

🚫 The WTI daily spot price measured at the Cushing, OK terminal will exceed $100/bbl during 2025, because of military action. UPDATE 2025-06-29: The military action happened, and WTI did not crack $76/bbl. If the IAF can’t spike oil prices, no one can.

The American economy falls into recession, as a consequence of the 12-month Consumer Price Index (CPI) rising above 8%.

REMOTE CHANCE (0-5%)

The Trump Administration 1) successfully remove Jerome Powell from office in 2025, then 2) installs a partisan Fed Chair, who 3) reduces the Federal Funds rate to 2.5% or below, which 4) returns a 12-month CPI rising above 10% within 2 quarters.

Grading Me

Because I’m setting predictions based on probabilities, grading my predictions is not as simple as “Which ones did I get right?” In the spirit of accountability (and entertainment), here’s how you should grade my predictions by probability.

ALMOST CERTAIN (95-99%): If I’m correct, I get 0 points. If I’m wrong on this, I get a zero for this game.

HIGHLY PROBABLE (80-95%) (Max 4 points): If I get five predictions correct, I get 4 points. If I get four or six predictions correct, I get 2 points. If I get three or fewer predictions correct, I get 0 points.

ROUGHLY EVEN (45-55%) (Max 2 points): If this happens and my italicized details are correct, I get 2 points. If this doesn’t happen, I get 1 point. If this happens but my italicized details are incorrect, I get 0 points.

HIGHLY IMPROBABLE (5-20%) (Max 4 points): For each prediction that doesn’t occur, I get 1 point. If either or both predictions occurs, and my respective italicized detail is correct, I get 2 points per accurate prediction. If either or both predictions occurs, and my respective italicized detail is incorrect, I get 0 points per inaccurate prediction.

REMOTE CHANCE (0-5%): If this prediction doesn’t occur, I get 0 points. If this occurs and italicized details are all sequentially correct, I get full points for this game. If this occurs and turns out fine, then all of us are wrong.

This points system gets me to a score out of ten. Grade me accordingly in January 2026.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not reflect those of their current or previous employers or any elected officials. The author makes no recommendations toward any electric utility, regulatory body, or other organization. While certain information contained herein has been obtained from sources believed to be reliable, the author has not independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author assumes no liability for this information and no obligation to update the information or analysis contained herein in the future.

Get out with Brent—all my homies index with WTI.

This is not the cost to get a barrel of oil out of the ground—this is the IMF’s estimate of what oil price Saudi Arabia would need to fund its government. The country can run a deficit, for now…

I have heard murmurings that Saudi Arabia might ditch the OPEC+ target of $100/bbl, wage a price war with its cartel compatriots to get them in line, and push prices down to $50/bbl. But I’ve only heard murmuring. I’m skeptical, because a price war wouldn’t necessarily scare OPEC+ countries into listening to production quotas—it could convince them to wave off all future price quotas as bossy Saudi decrees.

Note the “shadow fleet” isn’t necessarily that shadowy.

I do care, but the current business model of intermittent renewable energy does not.