Against Nuclear

It’s not the silver bullet you think it is

There’s a category of energy analyst, independent of the greentech shills, probably older than the gas-trading memesters on Twitter, that posts constantly about “Green Scam” this and “Carbon Delusion” that. Let’s name some of them: Doomberg, Robert Bryce, Isaac Orr, Mitch Rolling, Alex Epstein. Hey, boys.

They (correctly) describe the downside tradeoffs of intermittent renewable technologies like wind, solar, and battery energy storage, (correctly) note the upside benefits of shale hydrocarbon production and LNG exports, and (correctly) rail against permitting hurdles to American energy infrastructure. But interestingly, they’re all huge proponents for nuclear electric generation. It’s great stuff, they say. We should build more nukes, they say. In fact, they say, it’s the Future of American Energy™️.

Nuclear is not the future of energy—just a part of it. Nuclear, like intermittent renewables, has tradeoffs.1

Baseload is Overrated

One benefit of large nuclear plants is that they supply baseload electricity. Whereas intermittent renewables generate when they feel like it, nuclear plants run all the time. The core technology is merely hot rocks making their own Jacuzzi, and those hot rocks stay hot independent of the weather. This, the anti-green energy analyst claims, means that nuclear good and solar panel bad.

But this assumes that baseload is necessarily good. I have some graphs that suggest otherwise.

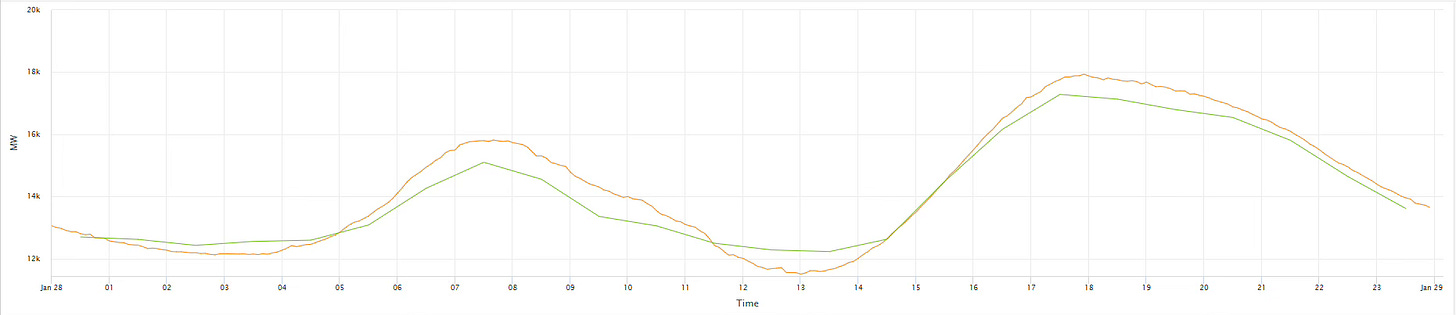

This was the ISO-NE system load on 28 January 2025. Green is what cleared on the day-ahead market at 10:30 AM on the prior day, and orange is what actually happened.2 Look at noon—demand fell below market expectations.

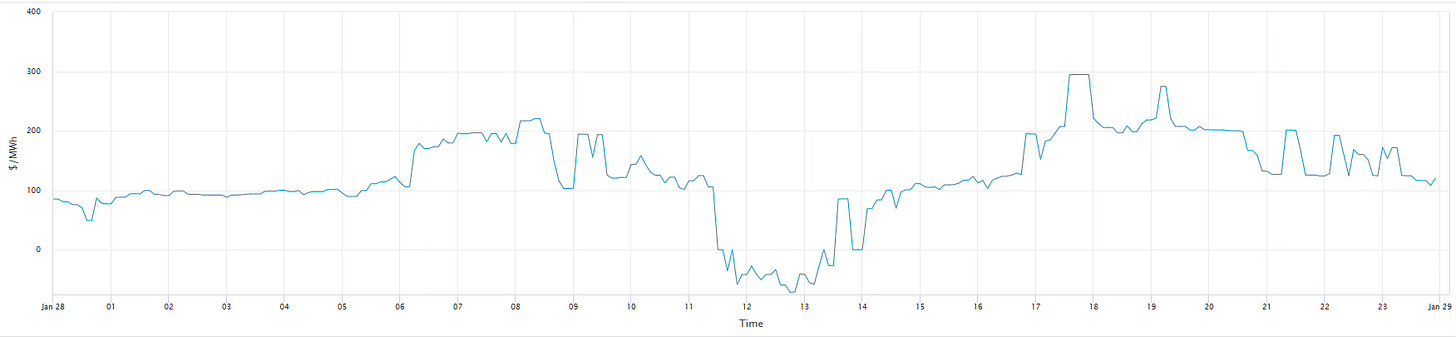

This led to strangeness in the five-minute real-time wholesale electricity spot price:

As behind-the-meter solar production pushed midday grid demand below forecasts, the spot price fell below zero. Between 11:30 AM and 1:30 PM, producers paid the grid to generate. That’s the wrong way round.

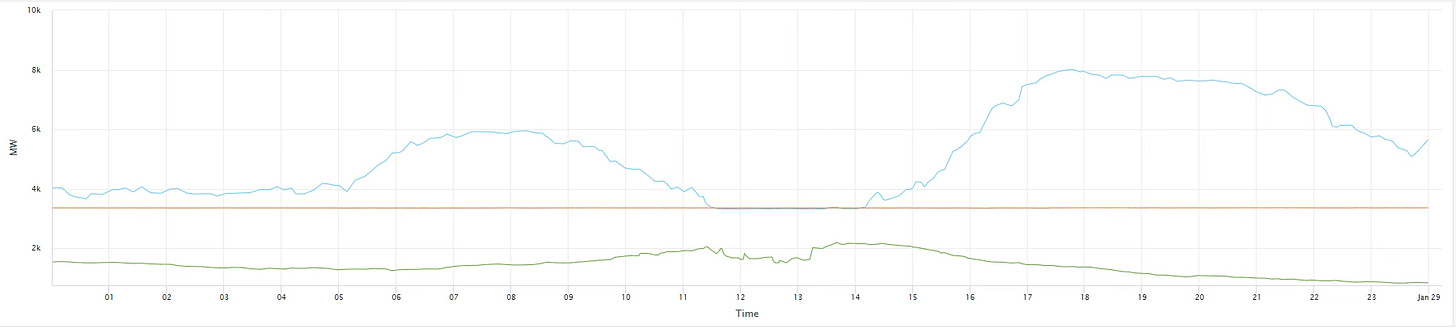

You can see the reactions to this in the resource mix. I’ve isolated three fuel types in the below chart: light blue is natural gas, orange is nuclear, and green is renewables—wind, solar, biomass, waste incineration, but not hydroelectric.

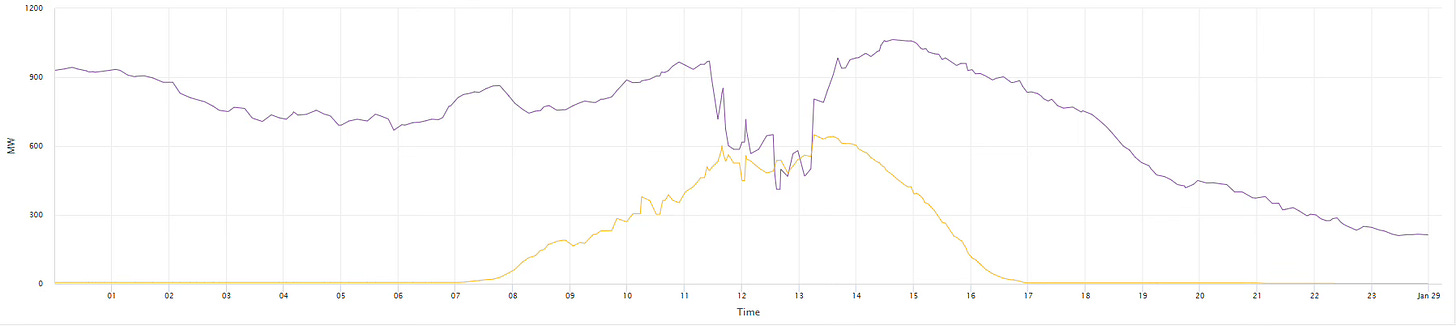

During the negative price event, gas and renewables generation dropped abruptly. If we isolate out wind and solar, we can see that some—but not all—intermittent generator operators glanced at their terminals, panicked, and pulled the plug on their inverters.

After the negative price event, renewables generation returned briefly but fell away as the sun set and the wind died down. Gas generation, meanwhile, continued to ramp towards the day’s demand peak around 6 PM.

Nuclear, meanwhile, did nothing.

This is what baseload generation entails: flat, unresponsive generation. This actually isn’t great, because electric demand moves—and in an age of behind-the-meter generation and stochastic EV charging, it moves a lot.

On this low-thirties duck-curve (!!) Tuesday in January, this was a mere L in Seabrook’s and Millstone’s income statements. But on some spring or autumn afternoon in the early 2030s, ISO-NE suspects that behind-the-meter solar will drive grid demand so low that all generation assets will need to ramp down…including the nuclear assets, which cannot ramp down.

Adding more nuclear baseload would make that problem worse.

Natural gas isn’t a good generation fuel because it’s baseload. It’s good because it’s dispatchable. You can ramp a gas generator up and down whenever you like—in fact, a gas peaker can go from cold to full-blast to cold again in a couple of hours. That’s what the grid needs most.

Even intermittent renewables are more dispatchable than nuclear—at least you can curtail at the inverter.

The Supply Chain is Vulnerable

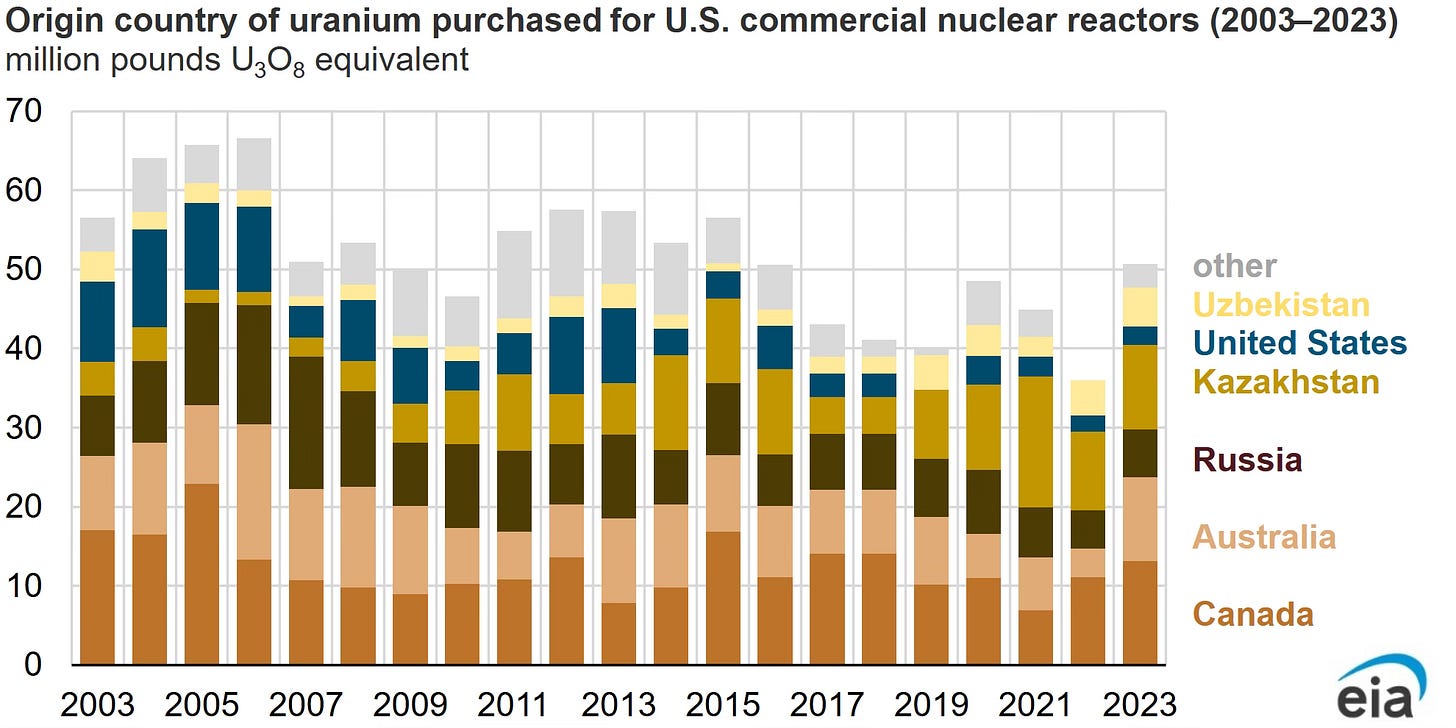

In 2023, the United States imported 99% of the uranium concentrate used for nuclear fuel. The two biggest origin countries were Canada and Australia—acceptable. The next three were Russia, Kazakhstan, and Uzbekistan. The United States banned imports of Russian uranium starting August 2024, but we left a waiver option open through the end of 2027. We had to.

Kazakhstan and Uzbekistan, meanwhile, are survivors of some of the worst deeds of the Soviet Union. Moscow drained the Aral Sea to grow cotton, unleashing toxic dust storms across Central Asia. Kazakhstan particularly saw a famine that took 1.5 million and widespread contamination from nuclear weapons testing. These nations crashed into the ‘90s enervated and dependent on Russia. Their bids for economic autonomy necessitated kowtowing 叩頭 to China as a counterbalance.

A significant portion of American nuclear generation depends on two countries straddling the spheres of influence of our two most dangerous strategic adversaries. We can plug this gap by scaling our uranium concentrate production by 6,000%.

Chop, chop.

…Okay, I Lied, Here’s the Actual Problem

Let’s talk about Vogtle. The Alvin W. Vogtle Electric Plant was a two-unit nuclear generation plant commissioned in Georgia in the late ‘80s. In 2013, energy megacorp Southern Company sought to expand the plant with two more units. This would be the first new nuclear project approved since Three Mile Island melted down. The project was NRC-approved in 2009, with a target commission date in 2017 and a budget of 14B USD.

That didn’t happen.

The project was derailed by abrupt changes in the construction plan, backlash in the aftermath of the Fukushima disaster, the bankruptcy of the company designing the reactors, and a series of vignettes that will be picked apart in MBA courses for the next twenty years. Both units were commissioned by 2024. The final construction cost was 36.8B USD.

In the aftermath of this project, I attended a talk by Chris Womack, CEO of Southern Company. When asked about Vogtle, he said he regretted nothing. This is simply what happens when you build the first American nuclear plant in thirty years.

Electricity from existing nuclear plants is cheap for the same reason driving a 1996 Geo Metro is cheap: the loans are paid, it’s too sturdy to die, and no else wants it.3 But if you want to build a new gigawatt-scale nuclear plant, you will find zero domestic capacity for design, NRC approval, local permitting, or construction. To restore the honor of Vermont Yankee, you would need to source foreign engineering talent,4 bomb the Conservation Law Foundation’s Boston office, and outdo the Big Dig in construction largesse.

What’s the levelized cost of electricity on that?

I Can’t Buy an SMR

But this point, the anti-green energy analyst is chomping at the bit to talk about small modular nuclear reactors (SMRs). SMRs are a family of nuclear reactor designs, many spinning out of American National Labs. These systems are supposed to be small, safer than conventional designs, and typically replicable in a factory. Some of them are purportedly dispatchable, obviating my earlier point about baseload energy.

Notionally, these systems, like iron-air storage, low-temp advanced geothermal, renewable hydrogen and natural gas, and direct-air carbon capture, will solve our Kobayashi Maru problem when they achieve at-scale production in the mid-2030s. But can a utility buy a small modular reactor? I have seriously asked this question in my professional capacity. And the answer is no. China and Russia claim they can build one, but they see poisoning Central Asian minorities with an experimental nuclear plant as a two-birds-one-stone victory.

It would be cool if SMRs scaled up production, but I’m already looking at ten-year energy resource plans. My public utilities commission will not accept “trust me bro, the cavalry is coming.” Unless I can sign a contract that promises me 5MW of your wunderklimatechnik by year X or my money back, stop making promises on it.

Are there deep problems with a decarbonized grid based on distributed renewables? Yes, and I have spoken on some of them. But if offshore wind, or electric vehicles, or demand response are greenpilled delusions, then what is your dream of a revived Pilgrim Power Station? Elon thinks he can solve American energy with Tesla products, and I don’t believe him, either. But at least I can buy a Cybertruck, solar system, and vehicle-to-house gateway, and they would be moving electrons in six weeks.5

Abandon Ideology; Embrace Localized Tradeoffs

If there were a single energy source to rule them all, it would be shale natural gas. But not even the anti-green energy analysts embrace unconventional hydrocarbons as a full-stop Future of American Energy™️. In the 2020s, in the aftermath of COVID and the Russo-Ukraine war, even the anti-greens are talking about emissions, defending natural gas as a carbon-reduction technology relative to coal.

But they’re still ideologues, because they cannot name the negative tradeoffs of their favored energy technologies.6

The truth is that every energy technology has tradeoffs, and that those tradeoffs adjust based on location. The Pacific Northwest has an abundance of hydroelectric power. The Plains have incredible wind resource and potentially an angle for biofuels. New England has easy access to Marcellus gas, Quebecker hydro, and offshore wind, if we permit ourselves to build the infrastructure (we won’t).

The future of energy is a local question, and it’s a messy question. No matter what, the solution will be ugly and expensive. Technology can only help at the margin. The miracles will take too long to scale.

Anyone who claims otherwise is an ideologue.

In this sector, that’s near enough to lying.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not reflect those of their current or previous employers or any elected officials. The author makes no recommendations toward any electric utility, regulatory body, or other organization. While certain information contained herein has been obtained from sources believed to be reliable, the author has not independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author assumes no liability for this information and no obligation to update the information or analysis contained herein in the future.

Some of the folks I tagged may respond, “Of course nuclear has tradeoffs!” Then why didn’t you write about them?

I’m not using ISO-NE’s forecasts here. Every time ISO-NE updates their Morning Reports at 8AM, 12PM and 4PM, they update their forecasts, backfilling erroneous predictions so that they more closely match actual demand. In my eyes, this amounts to lying.

The Emissions-Free Energy Certificates (EFECs) generated by New England nuclear plants are near-worthless on REC markets. In fact, they’re inadmissible for Vermont’s Renewable Energy Standard.

I’ll grant that the Westinghouse AP1000 is good enough tech, but Vogtle bankrupted Westinghouse. Would the next American project do the same?

I run some numbers on this here:

If you have gotten this far and think I’m against building new nuclear, you might be illiterate.

If you could wave a wand and have a optimum mix of generation, say one mix for east coast,one for west. What would it look like? Only mature tech.