BONUS: The Damage Was Done. We Can't Go Back.

American Mercantilism, American Idiots, Revisited

At midday yesterday, I checked my stock investments, which reflected a market reeling from Trump’s era-defining, history-book-warranting, likely-ChatGPT-derived Liberation Day tariffs. I’m still young, so the ominous red numbers are simply funny to me. So I texted a friend a three-month graph of the S&P 500:

That was at noon.

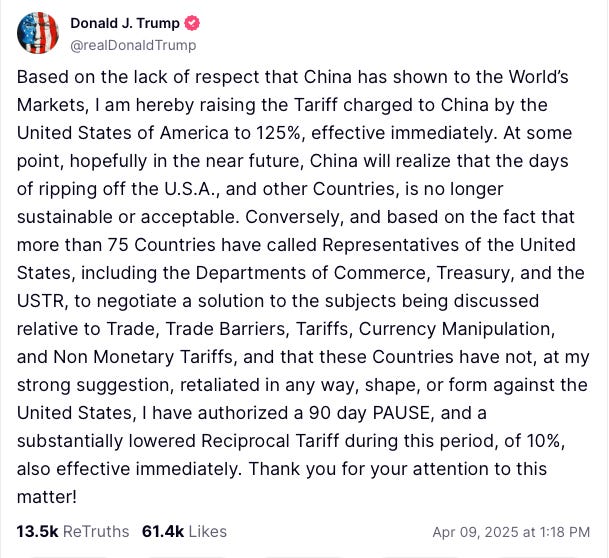

Ninety minutes later, Trump announced on Truth Social that he was reversing course.

Truth Social, of course, is not the United States Harmonized Tariff Schedule. I suspect that the tariffs presented on the President’s handy-dandy reference card were not fully on the books. I also suspect that very few items actually paid that tariff when crossing the border during the past week, because administrative changes do not happen within a week.

Regardless, the Standard and Poor’s Hive Mind Index cratered ten percent in response to that initial press conference, before recovering nearly all those losses by the end of yesterday.

“It’s over!” cried the bankers Friday, quite!

Yet "We're so back!" they cheered by Wedns'day night

Are We Truly This Stupid?

I started 2025 with a set of predictions about the year. There’s a quantitative version with hard bets, but the narrative version is more relevant here:

In this post, I talked about two core threads to Trump 2.0’s administrative trajectory: American mercantilism and American idiocy.

The mercantilism drives the optimistic views of Trump’s second term. There’s a strong sense among many Trump-aligned operators that the United States does need to re-orient its geopolitical and economic policy away from the Bretton Woods global order and a services-oriented economy. Trump himself has simple intuitions and no intention of clarifying his opinions, but as T. Greer has described, his staff are true believers in idiosyncratic but well-considered facets of what Trumpism could be. There are a myriad of opinions on the specifics, but no one has opinions recognizable to the GOP of George H.W. Bush.

In my initial post, I elaborated on this point with respect to weaponizing fossil fuel flows,1 but the Trump Administration is applying that mercantilist thinking to everything: to Trump, all imports are bad, merely for the fact they are imports. And people are defending this—some out of capture by a cult-of-personality, but many for well-thought-out reasons. Remember that the Biden Administration also sought to use the weight of the state—tariffs included—to pursue domestic reindustrialization. This is a bipartisan, populist mission.

I also called the idiocy. That’s not a flex; it was obvious from the start. I failed to imagine the depth of careless destruction from DOGE, and I didn’t expect Scott Bessent to be the fall guy. But direction was clear. Trump as a man hates sober experts, and the people who choose to associate with the President are disproportionately grifters, fools, and degenerates.

Taken together, one would predict that the second Trump Administration would tear down the last supports of the Liberal International Order in the messiest, stupidest way possible.

Lo and behold.

But the panic in the S&P 500, representing the intuitions of Wall Street’s id, suggests that 1) people were surprised by the contents of “Liberation Day,” and 2) those same people think that Trump was just joshing, and that we’re going back to normal now.

This Was a Long Time Coming

For some reason, Trump’s “reciprocal tariff” schedule was the Rubicon-crossing that convinced many people that The World Order Has Changed, and that the United States is no longer the paragon of the free world, or whatever.

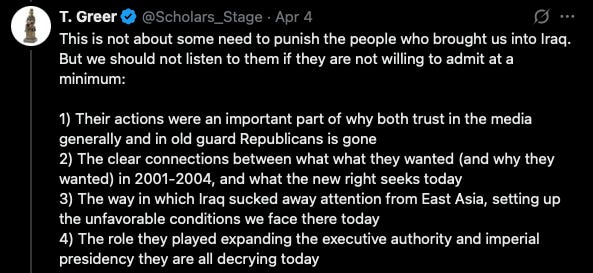

But that’s flatly incorrect. If you ask Peter Zeihan, he’d put end end date of the Bretton Woods order at the fall of the Berlin Wall, or at George H.W. Bush’s loss to inward-looking Bill Clinton. Recently, Greer suggested the Iraq War as the death blow for the Old America many miss:

I’m younger than all these commentators. The tipping point I remember was the Biden Presidency, in which Uncle Joe’s military and economic policy suggested that he had no strategic disagreements with Donald J. Trump.

What did y’all think deglobalization meant? vibes? papers? essays? losers.

We’re Not Going Back

And yet somehow, financial analysts and the rubes who play them on Twitter think things will turn out normal?

The ship has sailed. The volatility, the risk, is already priced in. Every capitalization plan has been adjusted with the expectation that at any given import product, at any given time, will be hit with a tariff of any given percentage, with little notice and even less procedural clarity. Every program dependent on federal action has been adjusted with the expectation that your point of contact may disappear, that your grant dollars may be frozen, and that your approvals may suddenly be reversed in a fit of pique or a blind DOGE cancellation.

By my understanding, the business investment has already slowed and the risk premiums have already increased. And abroad, nations are acting accordingly. Military retooling will take years, and de-dollarization will require localized alternatives, but no one will go back.

Think—imagine Michelle Obama wins the Presidency in 2028. Will NATO accept American hegemony like nothing happened? Will Canada return to a NAFTA-style arrangement? Will China back down from their military ambitions? Or will every business and political leader remember that come next election, a Peronist populist could tear down any détente or free trade agreement to the cheers of a plurality of the American electorate?

The Bretton Woods era, the Liberal International Order, the flat global economy, are dead. They’ve been dead. And no one can bring them back.

Start thinking about spheres of influence.

Start thinking about supply chain conflicts.

Start thinking about shortages in capital, labor, and inputs.

The ‘90s are not coming back.

And double-elaborated in an article for DARC.