Increasing Natural Gas Generation is No Longer an Option

The hardware is sold out to 2030 minimum

Hey—you want a rumor?

On 3 February 2025, the think tank Institute for Progress (IFP) released the report Compute in America: A Policy Playbook, which provides a strong breakout of the key bottlenecks to building the large-scale computational resources necessary for “big data” and AI. It’s a cool report, and it offhand mentions that gas generation turbine manufacturer GE Vernova “is reportedly sold out beyond 2030.”

I checked the sourcing, and it leads to an August 2024 report by Global Energy Monitor that does not say that but instead notes that gas turbine manufacturers are ping-ponging between record profits and nightmare sales crunches, reliant on Chinese demand and seeking consolidation options—even with Chinese partners.

GE Vernova’s FY2024 financials kinda reflect this. In Financial Year 2024, they made $18B in power systems[1] revenue but ended with an order backlog of $74B. That’s more than four years of revenue, out to approximately mid-year 2028.

One is an event.

Then on 6 March 2025, I got a newsletter alert from consulting firm Wood Mackenzie talking about electricity demand for (again) large-scale compute, in which bigshot consultant Chris Seiple says:

We recently managed a turbine solicitation for a customer and learned that if you don’t already have a turbine manufacturing slot, the earliest you will get a new combined-cycle power plant online – assuming everything goes perfectly – is Q4 2029.

Two is a coincidence.

Soon afterwards, I chatted with an expert on datacenters in an unrelated meeting, and I brought up this rumor:

“I heard gas turbines are out of stock out to 2030.”

“Yeah, we’ve heard that too.”

Three is real activity.1

And so, I’m sharing that rumor with you: If you want a gas turbine of 50MW or greater, you’re not getting one until 2030 at earliest. And if you don’t believe me, believe Mitch Gainer:

Why Can’t They Speed Up Production?

That’s a good question. The three largest players in gas turbine manufacturing are GE Vernova (plus its Chinese joint venture Harbin Electric), Dongfang Electric (working in joint venture with Mitsubishi Power), and Siemens Energy.

These are giant systems, room-sized things before you tack on thermal management, emissions controls, and electrical equipment. Each of these companies has a live fleet of a few thousand, maybe tens of thousands of these units operating. Each turbine costs tens of millions of dollars to order, to say nothing of the overhead, capital expenditure, and labor training requirements to build one.

Speeding up production of gas turbines would likely require new factory floor space, staff, heavy equipment, and materials contracts. Billions of dollars invested, to be spent over three to five years and recouped over ten to fifteen more.

Run that clock from 2025. Your expanded production would—if you’re fast—kick in around 2028. And you would use that expanded capacity beyond what you can produce in 2025 to sell extra turbines into…2040? 2045?

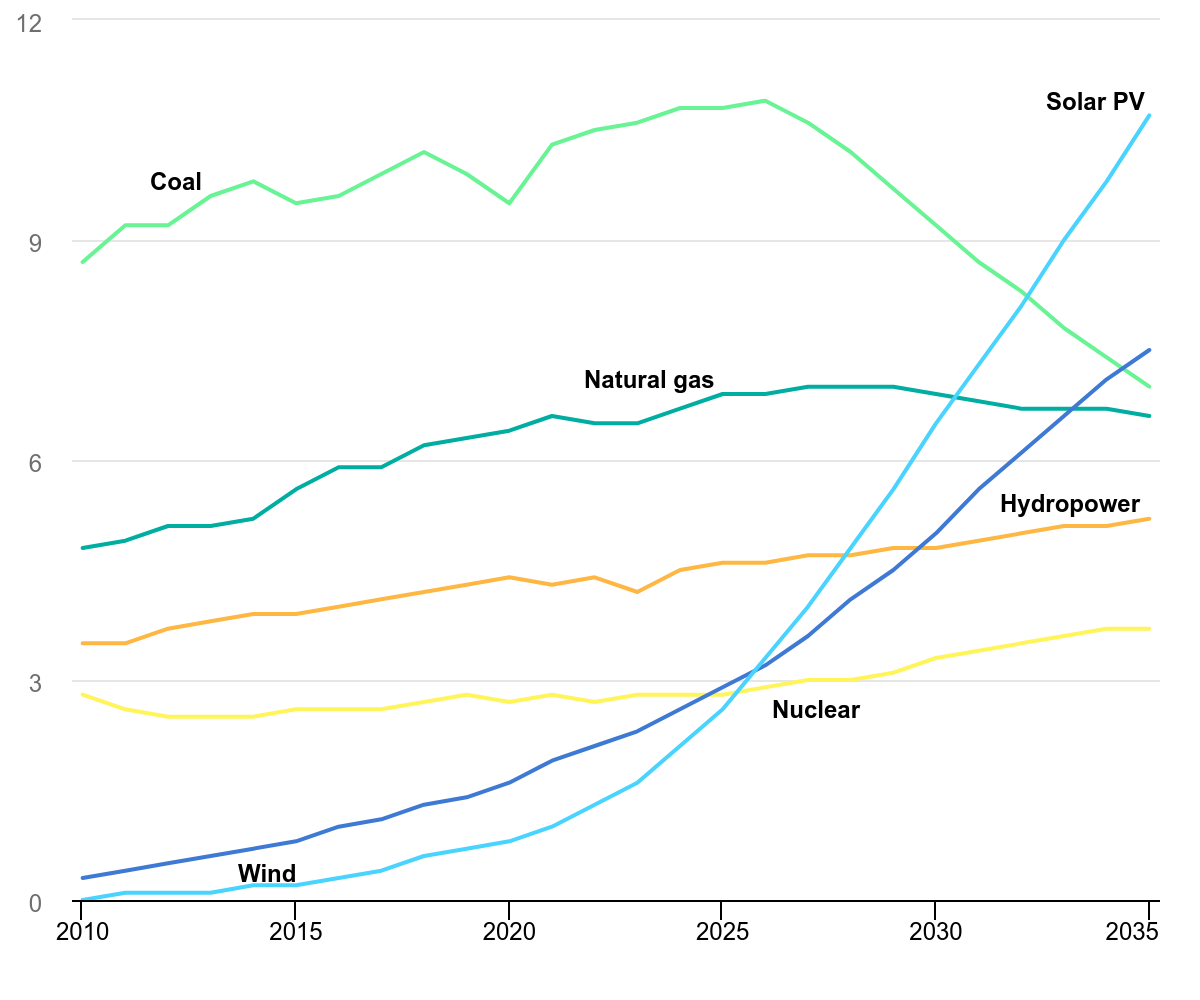

The International Energy Agency’s World Energy Outlook 2024 projects that natural gas electric generation will be flat globally between 2025 and 2035. That projection won’t justify increasing production capacity by 1.5x, but they’re Europeans trying to make “fetch” happen with decarbonization policy.

GE Vernova’s 2024 financials suggest they “expect gas power generation [capacity] to increase at low-single digit rates, playing a critical role supporting load growth, maintaining grid stability, and energy security.” That’s where I would put my forecast, but that also does not justify increasing production capacity by 1.5x. It does justify incremental investment and a higher margin from auctioning “priority slots,” which is exactly what turbine manufacturers are doing. Mitch Gainer reports that some companies like Hanwha Power and Baker Hughes are getting into the turbine business for themselves, but that’s for sustaining existing hardware, not new builds. Making fresh turbines at home just means you hold the risk of stranded assets instead of Mitsubishi Power—and that’s actually not a win.

All this means that anyone who wants more new gas power generation needs to make a two hundred billion dollar promise to a gas turbine manufacturer that scaling up production will be worth their time.

Two entities can make that promise: The United States Congress, and the Politburo of the Chinese Communist Party.

That’s not you.

What Are Your Options?

If you are a decisionmaker at an electric utility, energy services company, or government planning organization, you know that you need more electricity. And if a new combined-cycle gas turbine facility is not happening in time for your impending data center boom / industrial buildout / war with a particular rapidly-ascending geopolitical rival, you have to run through your options:

Small “temporary” solutions at the 10 kW-10 MW scale: These can be diesel or gas-based, rolled in by truck, and potentially mass-produced. But they’re bound to be janky and inefficient.

Dismantling a jet engine: A single engine off a commercial airliner could probably put out 20-40 MW if converted into a peaker power plant. As a peaker, it would be fantastic. But this type of system is also bound to be janky and inefficient, and they’ll have severe limitations on service life because they’re used jet engines. I also don’t know how difficult or expensive this would be to install.

Nuclear: Huge if you can build them. I have my concerns.

Offshore Wind: This is GE Vernova’s angle for expansion—they’re the supplier for Vineyard Wind, but even after construction started, there have been problems.

Deferred Retirements: This is the cheapest approach in the short-term—just don’t let power plants shut down. Environmentalists will point out that these old plants are disproportionately coal and oil, and I’ll also add that power plants shut down for a reason. Retiring plants are typically very old and frequently no longer profitable. Expect a lot of these power plants to ask for subsidy money to stay online, because otherwise they simply will not stay solvent.

…Alternately, you build solar and storage.

There are so many problems with the dream of rebuilding the grid with distributed solar, storage, and flexible-load systems: intermittency, reliance on critical minerals, dependence on Chinese manufacturing, upfront capital costs, and most pressingly the Millennial Snot of its loudest proponents.

But you can buy it.

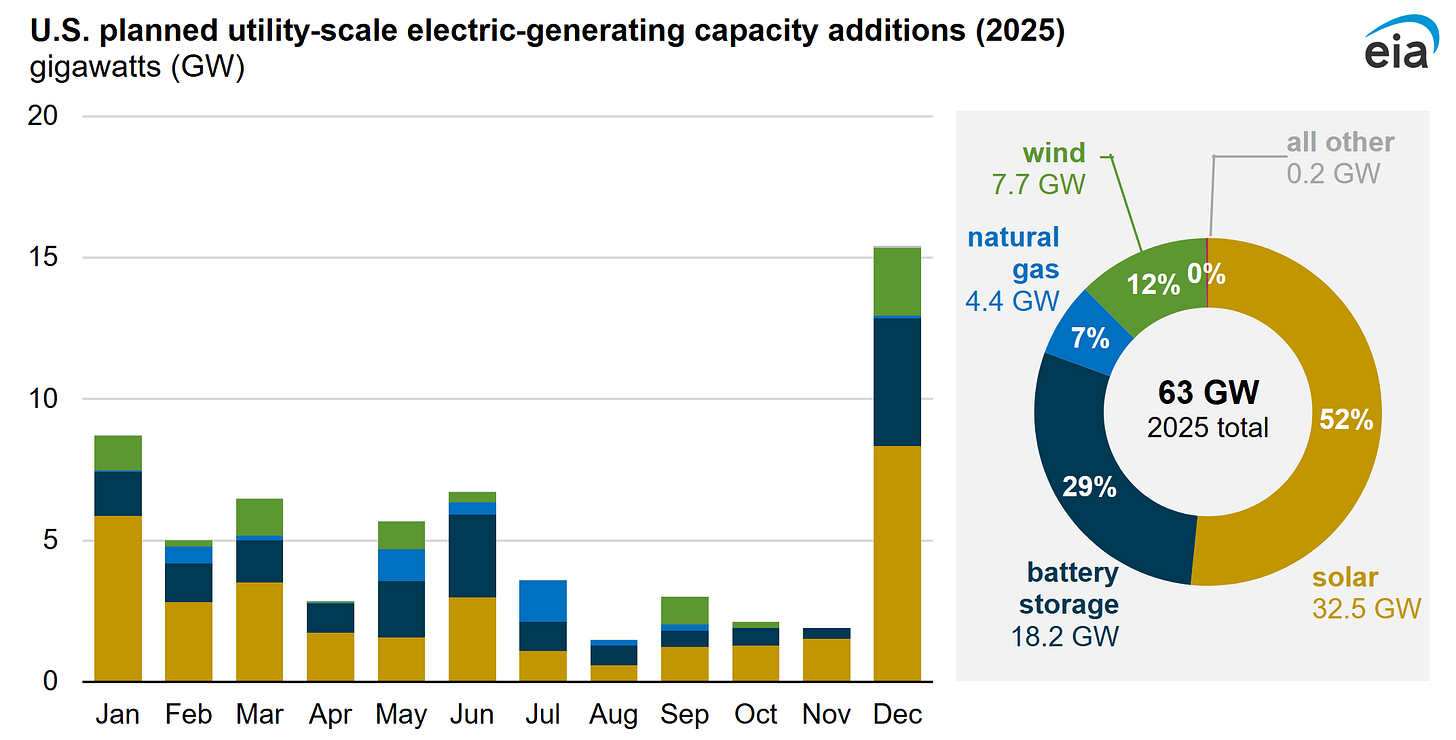

At the small scale, the municipal electric utility I work for could drop an RFP for 5 MW of grid storage tomorrow, and it could be powered up in 18 months. At the large scale, the EIA projects that half of the new capacity installed in 2025 will be solar, and almost a third will be battery energy storage.

This is imperfect, intermittent, mineral-intensive, land-intensive electrical capacity that is actually getting built. And that, Robert Bryce, matters more than on-paper reliability.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not reflect those of their current or previous employers or any elected officials. The author makes no recommendations toward any electric utility, regulatory body, or other organization. While certain information contained herein has been obtained from sources believed to be reliable, the author has not independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author assumes no liability for this information and no obligation to update the information or analysis contained herein in the future.

And if you want four, Semafor has heard the same from a conversation with the CEO of Mitsubishi Power Americas.

Very interesting, thanks for sharing! Beyond cost declines this may be the best argument for why solar’s momentum won’t stop

You can add this to your lineup (though note the “smaller units” mention, which might be re aeroderivatives even though it doesn’t mention the term):

https://www.utilitydive.com/news/georgia-power-natural-gas-turbine-delivery-delays-mitsubishi/758252/