Maura Healey’s “Energy Affordability Agenda” Is a Series of Lies

It's more than lies actually; it's an insult, too

In March, the Healey-Driscoll administration in Boston announced an “Energy Affordability Agenda” aimed at mitigating the massive rate shock that electric and gas customers have seen this past winter. It doesn’t solve the problem, and I’m frankly offended by its existence.

Let’s run through the agenda, which is replete with two distinct flavors of deceit:

Lies, Type 1: Stuff That is Already Happening

A good chunk of this agenda is stuff that was set in motion more than five years ago. These will reduce price shocks for customers (probably), but these are rich promises for the Healey administration to make because they would have happened anyway.

Demand Response: Already In Service

The ConnectedSolutions demand response program has been running since 2019, and I’m told it works pretty well. The high-gloss version enables you to plug a home battery energy storage system (like a Tesla PowerWall) into a grid-responsive rate that maybe makes back the $15k it cost to install, but Healey advertises the basic version that lets your electric utility touch your thermostat in return for a modest bill credit.

It’s a fine enough program. In fact, it’s been fine for six years now. It’s not new.

Killing the SRECs: Already Running Out

In prior posts, I’ve glossed over renewable energy credits (RECs), which are digital certificates marking a MWh of electricity generated by a renewable source. Normal RECs cost a little less than the $40/MWh alternative compliance payment that serve as a backstop for these RECs.

Massachusetts solar renewable energy credits (SRECs) work the same way, but they are motivated by a different legislative structure called the Solar Carve Out. For some godforsaken reason, the alternative compliance payments for these SRECs are *hundreds of dollars per MWh.* But the first wave of SREC requirements phase out at the end of the 2025 compliance year (probably June 2025), and the second wave phases out in 2029. The Healey administration is “working to get these costs off your bill,” but by working, they mean waiting for the clock to run out.

Reducing Volatility: A Transmission Line is Already Incoming

The New England Clean Energy Connect is a transmission line project from Hell.1 It was approved by FERC back in 2018, run through a legal battle that landed in the Maine Supreme Court, and got wrapped up in a ballot initiative to pull Maine electric utilities into a state-owned project. But it’s finally getting built, and in 2026, it is projected to move electrons from hydroelectric dams in Quebec to load centers in Boston.

It will reduce volatility. Maura Healey had nothing to do with it.

Lies, Type 2: Stuff That Will Not Solve the Problem

But not everything on this agenda is idle credit-taking. Some of it does require Healey to make people do things—particularly, the Department of Public Utilities (DPU) that regulates Massachusetts utilities. These are primarily things that Healey can do without waiting for the legislature, but they do not solve the underlying reasons why everyone’s energy bills were so high this past winter.

“Addressing” Competitive Suppliers: Axing Rubes

If you’re a customer of Eversource, National Grid, or Unitil in Massachusetts, you’ve likely gotten mail about changing some line-item in your electric bill to save money or go renewable or something. These are competitive suppliers. They’ll buy and sell wholesale electricity separately from power plant operators or electric utilities, playing middleman on your electric bill. Some municipalities contracted with competitive suppliers before the Russo-Ukrainian War, and they saved a lot of money when that war shocked global energy prices.

As I’ll get to in a moment, these competitive suppliers should easily be able to out-bid these investor-owned utilities (IOUs). And yet the Healey Administration claims these suppliers end up increasing customer bills. These suppliers are running either full-on con jobs or the power supply equivalent of those expensive hedge funds that can’t beat a basic index fund. Either way, the existence of these shops is an embarrassment, and I hope they lose all their money.

(Alternatively, many of these suppliers are doing fine, actually, and Healey is completely lying.)

Discount Rates: Redistributing the Pie

The Massachusetts DPU requires the investor-owned utilities to run discount rates for customers with low incomes, heat pumps, and electric vehicles. Healey’s agenda seeks to expand those discount rates to moderate-income customers and deepen those discounts for low-income customers. They will also require the IOUs to streamline (or fully automate) the discount rate enrollment process.

But again, the utilities will get their money back, and every dollar not collected from a discount-rate customer will instead get collected from a non-discount-rate customer. A good rule of thumb is that making under 80% of the area median income (AMI)2 marks you as “low income”, and making between 80% and 120% of AMI marks you as “moderate income.” Here’s an April 2024 measure of these income limit thresholds. Ask yourself whether you’d get a discount rate or the consequences of a discount rate.

“Immediate Relief”: Your Renewable Energy Charges Go to a Slush Fund, Apparently

Healey’s agenda leads with these “immediate relief” measures, but I consider them the most objectionable parts of her plan. The first piece of her “immediate relief” plan is dropping a $50 credit on the April electric bill of every customer of an electric IOU. Healey is cagey about where this money comes from, but it seems to come from the pool of alternative compliance payment funds that utilities pay into if they don’t meet their renewable energy portfolio targets. That money was supposed to “support clean energy,” but that apparently is a lie.

The second phase of “immediate relief” is forcing the investor-owned gas utilities to cut their March and April rates, which comes out to an estimated 10% reduction in customer bills. The Healey team claims this as a $95M savings to customers, but that’s also a lie. These gas utilities will recoup their money by increasing their retail gas rates through the rest of the year. Customers won’t notice: because their monthly gas usage (in therms) will drop, their increase in their gas rate (in $/therm) will skate by with limited complaint. It’s a different kind of IOU, and the gas utilities will get their money back.

So Why Did Your Energy Bills Go Crazy Last Winter?

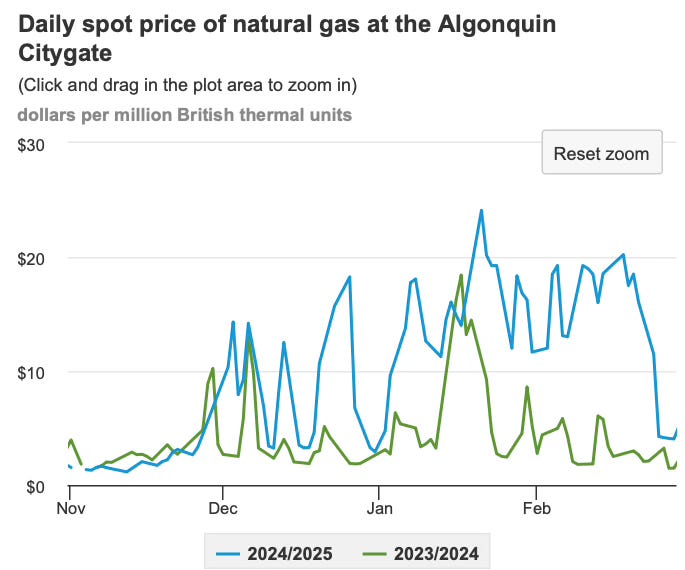

Peep this graph of wholesale natural gas prices at the Boston hub. Green was the Winter of ‘23-’24. Blue was this past winter:

Everyone in my industry thought that blue line would look a lot like the green line. We were wrong. This past winter turned out way colder, particular in January and February. Colder temperatures meant more gas demand. More gas demand meant more pressure on New England’s limited gas infrastructure. More demand with the same supply limits meant higher prices.

Of course, this was predictable. Maybe no one expected gas prices to get that high, but some increase was expected. And when traders expect an asset price to increase, they hedge in advance. Except in Massachusetts, investor-owned utilities are not allowed to hedge—they’re limited to six-month contracts. Municipal electric utilities are allowed to hedge, and they probably did fine through the winter. Competitive electric suppliers are allowed to hedge, and they should have come out ahead in this situation. But without a hedge to mitigate costs, the IOUs got punched in their bank accounts. And that price shock was transferred, one-to-one, to customers.

You weren’t scammed by the evil greedy utilities. You weren’t scammed by MassSave. There just wasn’t enough pipeline capacity. And it was really cold.

As much as I resent Maura Healey’s willingness to straight-up lie to ratepayers, I get why she did it. There’s no easy solution to this problem. Even if we agreed on what the problem actually is (we don’t), the solutions are all difficult and expensive. I would know—I mapped them out for my next post.

Next week we’ll talk about the potential futures of the electric grid—ideologies, technologies, tradeoffs. And unlike Governor Healey, I won’t lie to you.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not reflect those of their current or previous employers or any elected officials. The author makes no recommendations toward any electric utility, regulatory body, or other organization. While certain information contained herein has been obtained from sources believed to be reliable, the author has not independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author assumes no liability for this information and no obligation to update the information or analysis contained herein in the future.

Actually, all energy infrastructure projects are from Hell

Adjusted for family size