Trying to Understand the Day-Ahead Ancillary Services Market

Reserve power isn’t as certain as it once was

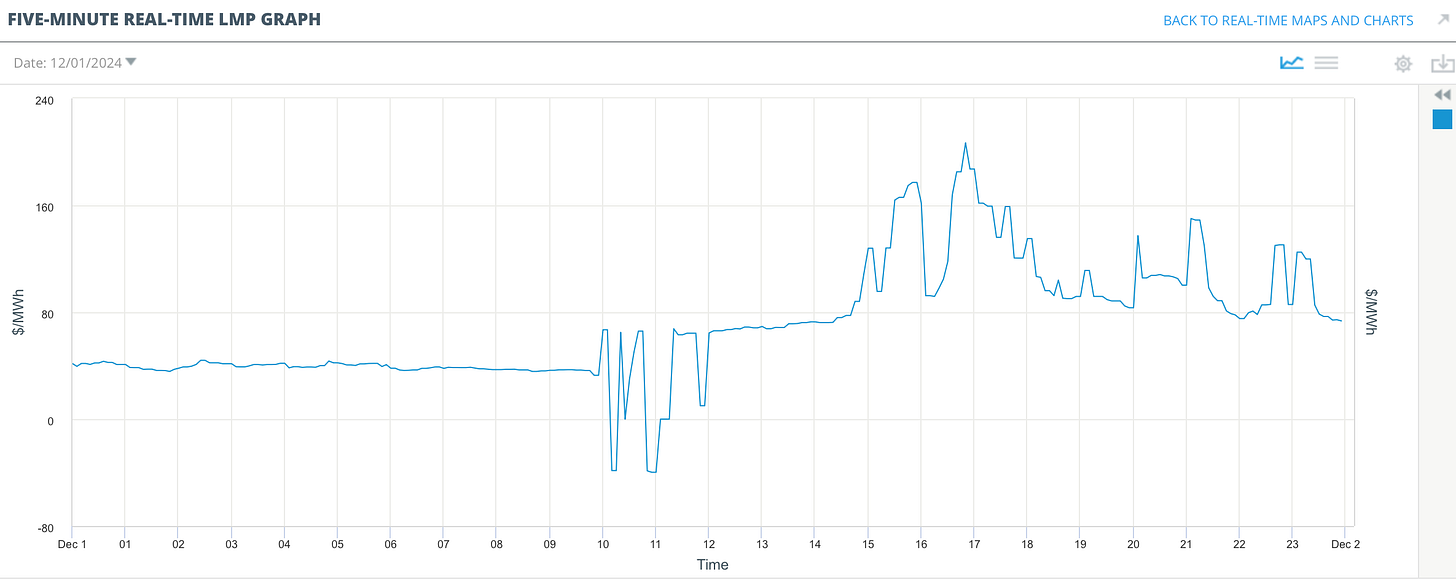

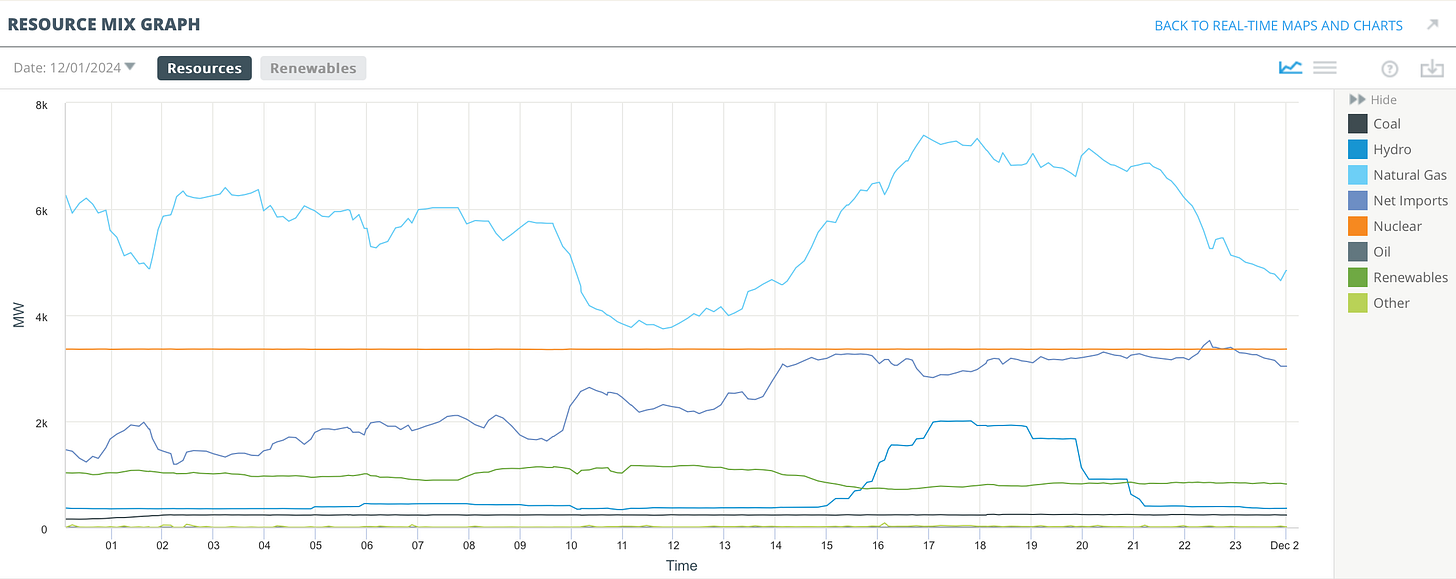

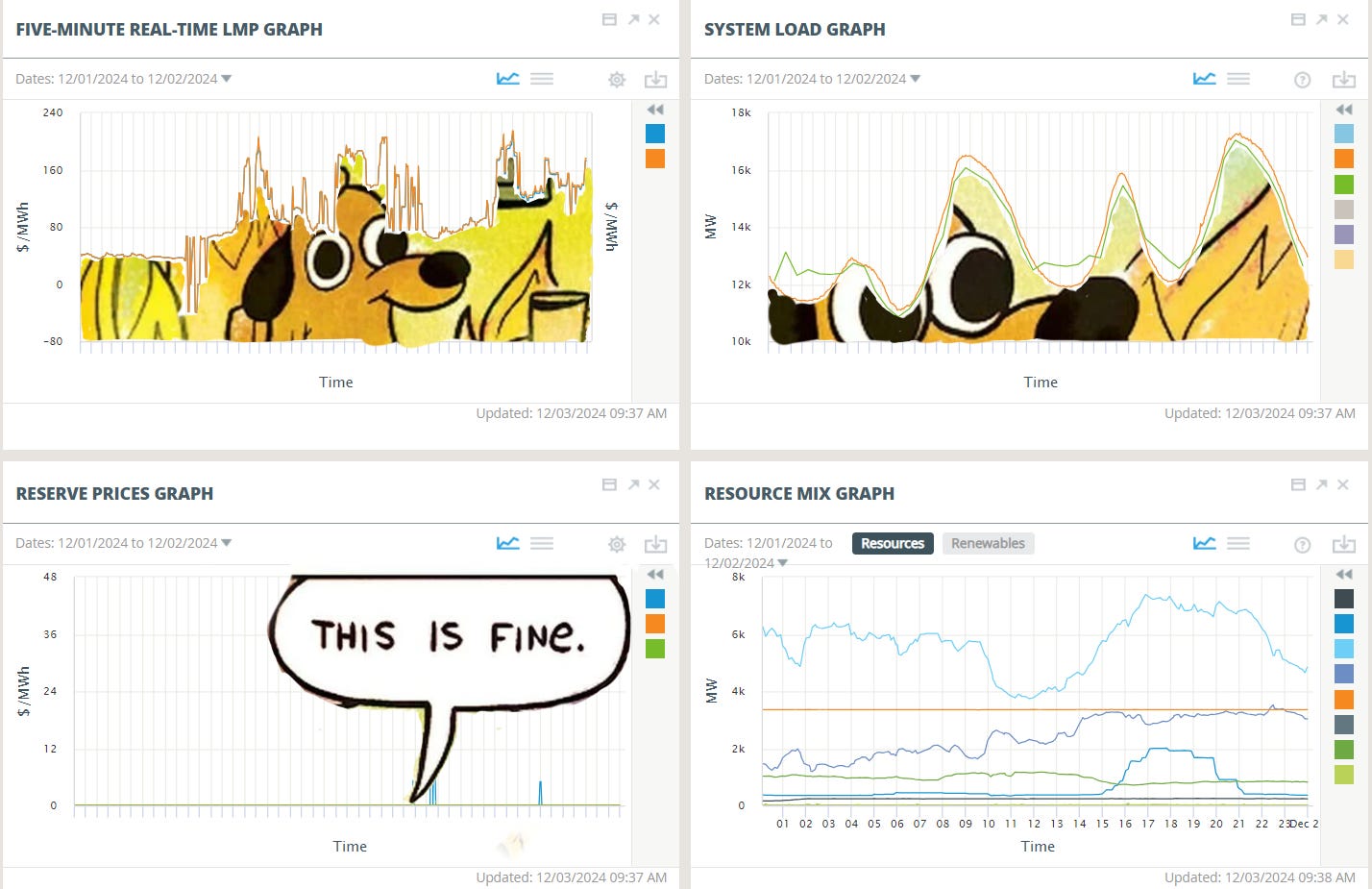

December 2024 started strangely on the ISO New England spot market. The morning trundled along normally, but between 10 AM and noon, the local marginal price (LMP) started ping-ponging between $65/MWh and negative $35/MWh as natural gas generation plummeted, balanced partially by import electricity and partially from a midday fall in demand.

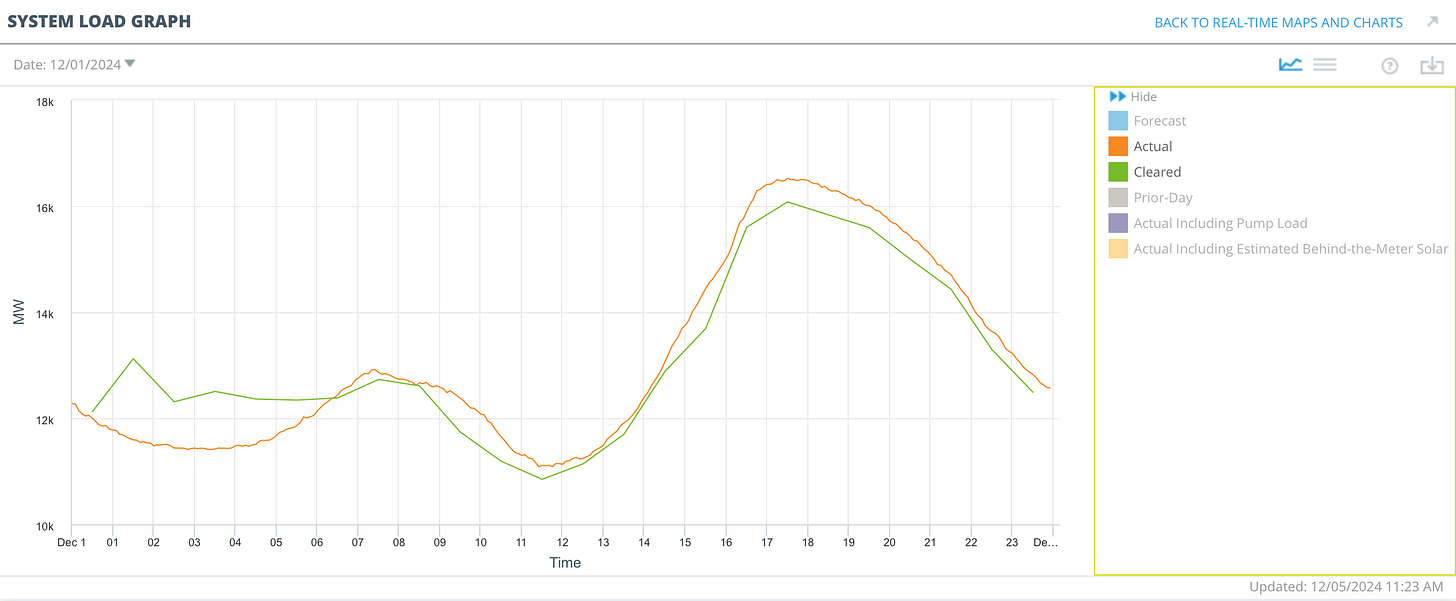

The temperature was just above freezing. The winter solstice was just three weeks away. Yet Sunday, 1 December was a duck-curve day. There was so much behind-the-meter generation, invisible to ISO-NE, that the lowest system load was at 11:25 AM.

And then demand started climbing, climbing beyond what had been cleared on the day-ahead market the previous morning. The spot price followed, running a roller-coaster price curve between a high $75/MWh and a double-take-motivating $175/MWh, eventually settling at 10PM.

Throughout this time period, real time reserve prices did…nothing. They weren’t supposed to—current reserve markets only care if a generator or transmission line goes down. ISO-NE simply didn’t have a plan for what happens if generation and demand fall out of sync, which is an increasingly likely problem in an era of intermittent generation and behind-the-meter solar.

Until now, that is.

The Day-Ahead Ancillary Services (DA A/S) market, set to launch on 1 March 2025, does two things:

Replace the Forward Reserve Market with a faster, more responsive alternative.

Introduce a new market to address short-term imbalances in generation and demand.

I’m struggling to wrap my head around this just like you are—this post is my attempt to make sense of it. Please correct me:

The Workflow: A New Set of ISO Forecasts

The previous Forward Reserve Market ran biannual, seasonal auctions: a summer (June-September) run, and a winter (October-May) run. The auctions would set a price per MW of reserve, paid upfront so that if and when reserve assets were needed, their bills would already be paid.

Converting this market from a twice-a-year event to a 365-times-a-year event required a bit legwork—in particular, for ISO-NE to stick a pin in the pricing chart and say, “Save yourself some time, and start bidding from here.”

This starts with two cost forecasts—a strike price, and an expected closeout price. The strike price is straightforward—it’s the forecasted LMP for each hour, plus $101. If the LMP rises above the strike price, something’s probably up. The expected closeout price is a projected spot price beyond that strike price, asking, “If the spot price rises above the strike price, how high is it likely to go?”

Add the expected closeout price to an estimate of avoidable input costs (calculated per generator), and you get a preset benchmark level. ISO-NE, effectively, is handing every generation operator a handy-dandy forecast saying, “Here’s a break-even price at which you should bid into the Day-Ahead Ancillary Services Market. If the spot price hits this cost per MWh, you should fire up your reserve asset.” This benchmark is recalculated daily at 5:30 in the morning.

Handy numbers—but we just missed something.

For (I think) the first time, ISO-NE is making their own forecasts for their own real-time energy market. We utility types have our own tools for forecasting LMPs, but now we get to (have to?) compare our forecasts to ISO-NE’s. And while they’re at it, they’re also making estimates of how much your generator (or storage asset) should cost to run.

Is ISO-NE’s methodology good? Maybe—their model hits all the variables I’d care about2. But it might motivate uncomfortable conversations about what things should cost—and why they don’t cost that much.

What Are You Bidding?

There are a few different kinds of reserve products. The Ten-Minute Spinning Reserve (TMSR), Ten-Minute Non-Spinning Reserve (TMNSR), and Thirty-Minute Operating Reserve (TMOR) products kick in during sudden outages. You bid on these depending on how quickly your generator can respond to sudden dispatch requests. In the real-time market, these products work unchanged—you’re just bidding in the day before instead of twice a year.

The new product is the Energy Imbalance Reserve (EIR). Its job is to mop up the difference between 1) the forecasted load for the next day and 2) the generation that cleared at 10:30 AM and got scheduled during the day-ahead market. It’s designed to address our December vignette. If you clear in the EIR market, you’re not required to run tomorrow—but you’re required to be on deck if demand ticks higher than the market expected. Think of it like the “double-Jeopardy” day-ahead energy market.

The conversion to day-ahead reserve markets gives different benefits for fossil-fuel and intermittent-renewable resources. For fossil-based generators, the faster ancillary services markets let operators make cleaner bets based on real-time spot prices. If you only get to make reserve bids twice per year, you have to make guesses about how much your fuel will cost you when you need it—and a lot can happen in six months. But if you’re re-bidding daily, you just need a formula that takes the price of oil or natural gas right now and returns a bid price. And hey, that’s what ISO-NE’s benchmark level does every morning!

For intermittent-renewable resources (wind, solar, hydro), this day-ahead market offers an angle for pairing storage with your generation resource. Because current Forward Reserve Market bids are longer than our capacity to predict wind and cloud cover, they’re off-limits to intermittent-renewable resources. But if you’re bidding in the reserve market daily, you just need to know how much you’re generating tomorrow, and how much of that energy is going to storage tomorrow. This will allow intermittent-renewable operators to play in the day-ahead energy market and in the day-ahead ancillary services market—at least if they have some storage.

The Angle: Faster Markets, More Forecasts

The ultimate angle here is that the electric grid is getting less predictable, and ISO-NE knows it. Intermittent generation resources are only as predictable as the weather, fossil fuel prices are now contingent on geopolitical factors, and one-to-three-year energy contracts aren’t strong enough guarantees in an era of fragile supply chains, wobbly capital, and sudden-death permitting battles.

Electric generators used to be predictable. Demand used to be predictable. And there used to be a margin of error. But now dispatchable generation is shutting down faster than intermittent generation is coming online, and the energy map around us is falling to chaos. I can tell you what a barrel of WTI crude costs right now, and I can even dig up the price of a six-month-away futures contract. But I can also rattle off five different ways that the price of oil could double in a week.

Annual markets need to turn seasonal, seasonal markets need to turn daily, and every number must become a stochastic projection, because we no longer know what the price of energy will be.

We must adapt: faster markets, more forecasts, greater automation, upfront payment of increasingly catastrophic tail risks.

The alternative is a brownout on some below-zero January night. At least three will die.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not reflect those of their current or previous employers or any elected officials. The author makes no recommendations toward any electric utility, regulatory body, or other organization. While certain information contained herein has been obtained from sources believed to be reliable, the author has not independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author assumes no liability for this information and no obligation to update the information or analysis contained herein in the future.

Probably a temp number.

The day-ahead load and weather forecasts, the previous day’s real-time prices, gas and fuel oil spot prices, and an “Is it Winter?” tag