What Do Import Tariffs Look Like in the New England Grid?

ISO-NE is hot on the case

At this point, we’re familiar with the Trump 2.0 promise to levy 25% tariffs on everything Canadian, which—as of the point you’re reading this—should already be in effect. However, Trump’s tweets Truths are not in-and-of-themselves policy. They need to be itemized by the Federal Trade Commission (FTC), enforced by Immigrations and Customs Enforcement (ICE), and propagated through private markets until they motivate behavior changes in those markets.

The Independent System Operator of New England (ISO-NE) just issued an “Exigent Circumstances” filing to the Federal Energy Regulatory Commission (FERC) toward this last point, in which they say “Not It!” while making a plan just in case they are, in fact, It.

You have questions. We all have questions. Let’s ask them in sequence.

What’s Actually Getting Tariffed?

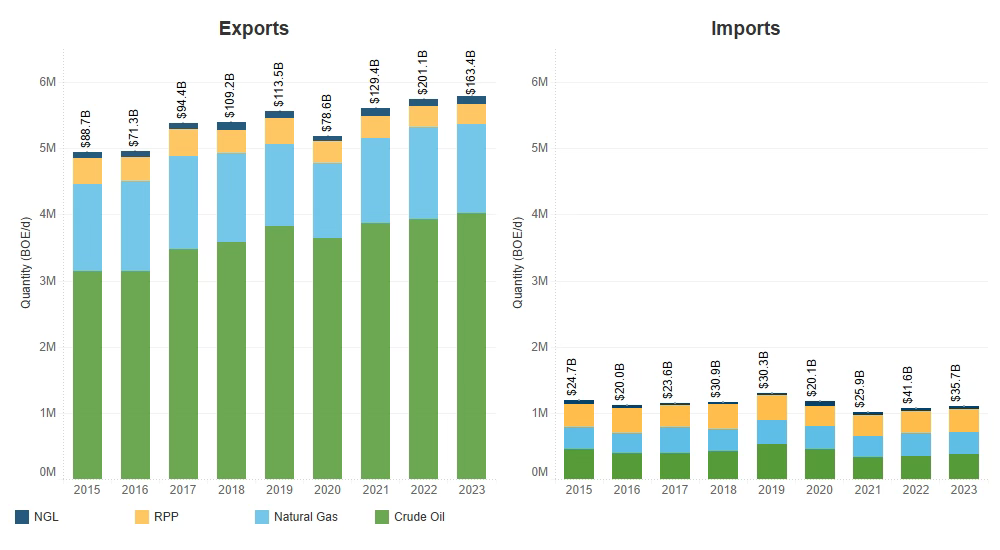

Depending on time-of-day and season, New England gets 9-15% of its electricity from imports. Of that, a majority comes from Canada—and in particular from Hydro-Québec, the proprietor of Québec’s massive fleet of hydroelectric generation and attendant transmission lines. A drought up north has evened out the trade balance in the past few years, but it remains beaucoup d'électricité for New England. We currently have three electricity import/export links to Canada: two are to Québec, and one is to New Brunswick. However, we’re currently building a fourth link called the New England Clean Energy Connect, which seeks to import yet more electricity from Québec. Merci, Québécois!

There’s also natural gas. New England has three links to Canadian gas pipelines: one links to an LNG terminal in New Brunswick, a second connects Québec to coastal Maine and New Hampshire, and a third supplies Vermont’s “urban” spine from St. Albans to Burlington. These first two pipelines link into the broader New England gas network, but they’re small compared to the gas inflows from the Marcellus shale field in western Pennsylvania. Serious import tariffs will reduce gas flows, and we won’t really notice the loss until next winter. Vermont, however, has no recourse. Bernietown is getting a 25% gas increase right in the jaw. Up yours, woke moralists…?

Will There Be a Tariff?

ISO-NE’s 26 February memo to the New England Power Pool (NEPOOL) suggests that they aren’t even sure if there will be an import tariff. First, they note that “import laws historically have treated electric energy as an ‘intangible’ not subject to tariffs.” The FTC’s Harmonized Tariff Schedule (HTS)1 currently marks “electrical energy”2 at a “Free” duty, whereas it marks natural gas3 with a footnote promising a 25% import tariff if it’s from China. I’m not sold on this argument—the second Trump Administration has not given much deference to precedent, and there is little reason for them to change tack here. But if and when those tariffs kick in, they’ll show up on the HTS.

…But as of end-of-day 7 March 2025, electrical energy is still marked as “duty-free.” There is no tariff on imported electricity. So I don’t know what is going here.

Regardless, ISO-NE argues that even if there is an import tariff on electricity, it should really go to someone else. But they’re not sold on that possibility—we’ll get to their countermeasure below.

How Much Will the Tariffs Be?

Based on the amount of electricity imported to New England, ISO-NE suspects that electricity import tariffs will reach $66M per year (at a 10% import tariff) or $165M per year (at 25%). ISO-NE’s total operating expenses are in the $230M range for calendar year 2024, and the Federal Energy Regulatory Commission (FERC) doesn’t allow organizations like ISO-NE to build a retroactive rate for cost recovery. If ISO-NE is hit with the bill without some immediate way to recover the costs, the tariffs would straight-up bankrupt them. The organization would survive the affair, but in the meanwhile, all electricity imports from Canada would likely stop.

That’s easily two gigawatts of consistent electric capacity gone. There’s no short-term replacement. We would see brownouts.

Who Will Pay for It?

I’m not actually sure that ISO-NE will be on the hook for these tariffs. Consider that power purchasers in New England do not technically buy wholesale electricity from Canada—instead, we buy it from Hydro-Québec Energy Services U.S. The import/export handoff for electricity happens between two subsidiaries of Hydro-Québec, so if an import tariff is supposed to apply at the border crossing, I’d argue that Hydro-Québec Energy Services U.S. is most likely on the hook from the Feds.4 Défoncez-vous, Québécois!

But ISO-NE isn’t waiting for the verdict: they made that “exigent circumstances” filing on 28 February to FERC, requesting to pull together a “temporary” cost recovery method, in which they invoice the import tariff cost “based on the amount of the Import Duty that is attributable to [an] entity’s sales into the New England Control Area of the electricity upon which the Import Duty has been imposed.” If you’ve sold 40% of the Canadian electricity in the New England market, ISO-NE is invoicing you for 40% of their import tariff bill. Notably, ISO-NE plans to do this even in the “absence of direction from [a] government agency.” Their filing harps on this assessment that they don’t know what’s going on. Maybe the Trump Administration knows that ISO-NE doesn’t buy electricity so much as settle other people’s transactions. Maybe they know that the “border crossings” for Canadian electricity are actually DC converters deep in American territory. But maybe they don’t. Maybe the White House will screw ISO-NE out of ignorance, inattention, or pique, and in that case, ISO-NE will pre-empt the chaos with a duct-tape solution that they’ll re-evaluate when the dust settles.

Regardless, ISO-NE’s tariff plan hands the bag to Hydro-Québec (and also the New Brunswick Energy Marketing Corporation, probably). And if these Canadian importers are left holding the bag, then they will absolutely look for a way to pass on that import tariff cost to their buyers, regardless of how it shows on their income statement. And those buyers of Canadian electricity, whether they’re buying Québécois or New Brunswicker, are almost all electric utilities. And they will absolutely pass that import tariff cost to their ratepayers.

No matter who pays when for what, the ultimate cost of an import tariff on electricity will reach the ratepayer.

Will I Notice it on My Electric Bill?

If you want some gut numbers, let’s figure:

33% of your electric bill is wholesale energy costs (as opposed to capacity, transmission, or distribution costs)

10% of that wholesale energy is Canadian

That Canadian energy is tariffed at 25%

All told, you’re looking at a 1% increase on your electric bill at most. You won’t notice the difference.

…At first.

My concerns lie elsewhere. Canada is also a major supplier of crude oil, of critical minerals, and so many key components from generator turbines to switchgear to transformers good God you need to worry more about transformers. These manufactured components are much more consequential on a long-term view simply because they’re already in short supply, and the last thing we need is a 25% tariff and a resulting slowdown on these underlying grid components.

Unless some key piece of paperwork falls through and things truly break (which is getting increasingly likely), the New England grid will simply eat the cost of import tariffs on wholesale electricity. But when we build more transmission lines, or procure grid-scale lithium batteries, or upgrade metering infrastructure, we’ll see import tariffs, both from finished goods and from subcomponents jumping back-and-forth across the border, ratchet up the project cost, line-item by line-item.

And remember: the ultimate cost of an import tariff will reach the ratepayer.

A Coda: “There Should Have Been a Process for This.”

During this whole fracas, the relevant committees on NEPOOL voiced a concern on the situation. They understood the need for haste on ISO-NE’s part, but they really wished they could have been part of this process. ISO-NE’s memo promised that their proposed cost-recovery mechanism would be a “temporary” fix, but I suspect their permanent fix will look strikingly similar. Sure, ISO-NE will open up a space for comment, and electricity importers will moan about how someone else should pay, and the market design analysts at ISO-NE will shrug, run their temp rate through a spell-checker, and get on with their lives. They’ve only given themselves 120 days to whip up a permanent solution, and they have bigger concerns.

This isn’t the only example. At the same time as all this, ISO-NE made a slight tweak to their capacity market financial assurance obligations without telling NEPOOL before hand. The adjustment was slight—and mostly a cover for an oversight from another slight adjustment—but it still motivated grousing.

But we should get over it. These processes typically add 3-6 months to a policy change, because you have to present to this committee and to that committee and allow for a comment period. Meanwhile, the Trump White House is filing Executive Orders rapid-fire, suplexing the NEPA regulatory structure before torching a deal with Ukraine with a live-on-C-SPAN shouting match. ISO-NE’s FERC filing mentions that there was supposed to be a 60-day notice period, but they’re asking for a waiver because the tariff was dropping two business days later.

There is no time for doing things properly, because the Trump team sees “doing things properly” as a waste of effort. So in response, ISO-NE dropped this internal tariff update on a Friday afternoon, made it effective that midnight, and trusted they could figure out the paperwork post-hoc. That’s a move that DOGE would pull: ship it fast, ship it sloppy, fix it later.

We will see more “exigent circumstances”—far more.

Get ready.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not reflect those of their current or previous employers or any elected officials. The author makes no recommendations toward any electric utility, regulatory body, or other organization. While certain information contained herein has been obtained from sources believed to be reliable, the author has not independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author assumes no liability for this information and no obligation to update the information or analysis contained herein in the future.

Not to be confused with Hayat Tahrir al-Sham

Item 2716.00.00, in MWh

Liquefied: item 2711.11.00, in m3. Gaseous: item 2711.21.00, in m3

This is ISO-NE’s argument in their FERC filing, too.