What Will It Take to Decarbonize the Grid?

This post ends with ugly questions

Between 2022 and 2024, ISO New England (ISO-NE) ran a comprehensive study to ask—seriously, soberly—what it would take to decarbonize the electric grid.

The result is the Economic Planning for the Clean Energy Transition (EPCET) report. The findings, unfortunately, are not pretty.

An Immense Buildout

The core challenge of decarbonizing the New England electric grid is that all currently-feasible renewable options—wind, water, solar—are intermittent: They generate when they feel like it. This means that generating enough intermittent energy for spring afternoons will require a lot of new generation, but managing the same feat for summer evenings will take an astronomical fleet of solar panels, wind turbines, and battery energy storage systems.

ISO-NE projects that meeting 2050 decarbonization goals will require building:

1.3 GW of offshore wind…every year

1 GW of solar…every year

250 MW of onshore wind…every year

1 MW of batteries…every year

We’re not even close to that pace.

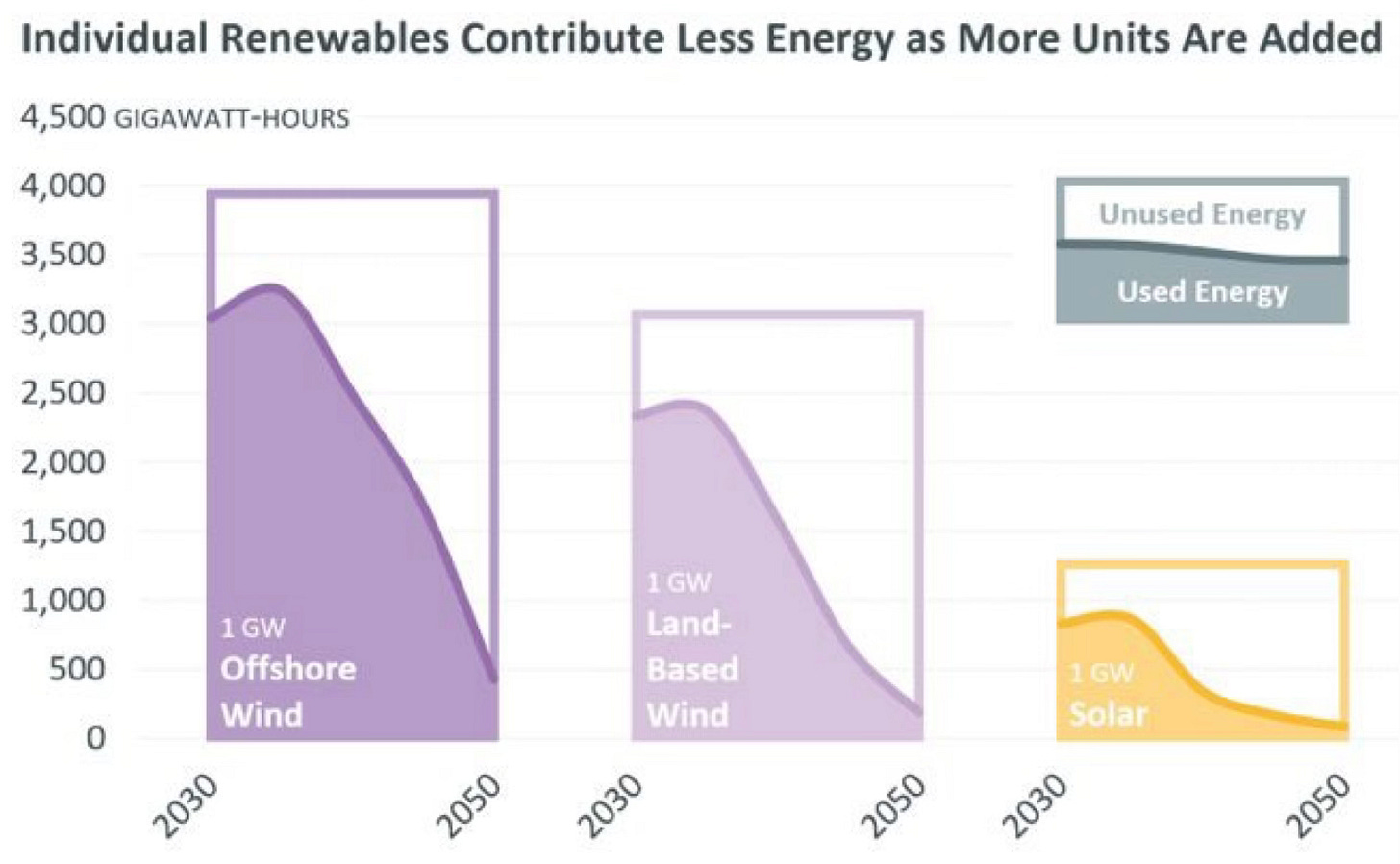

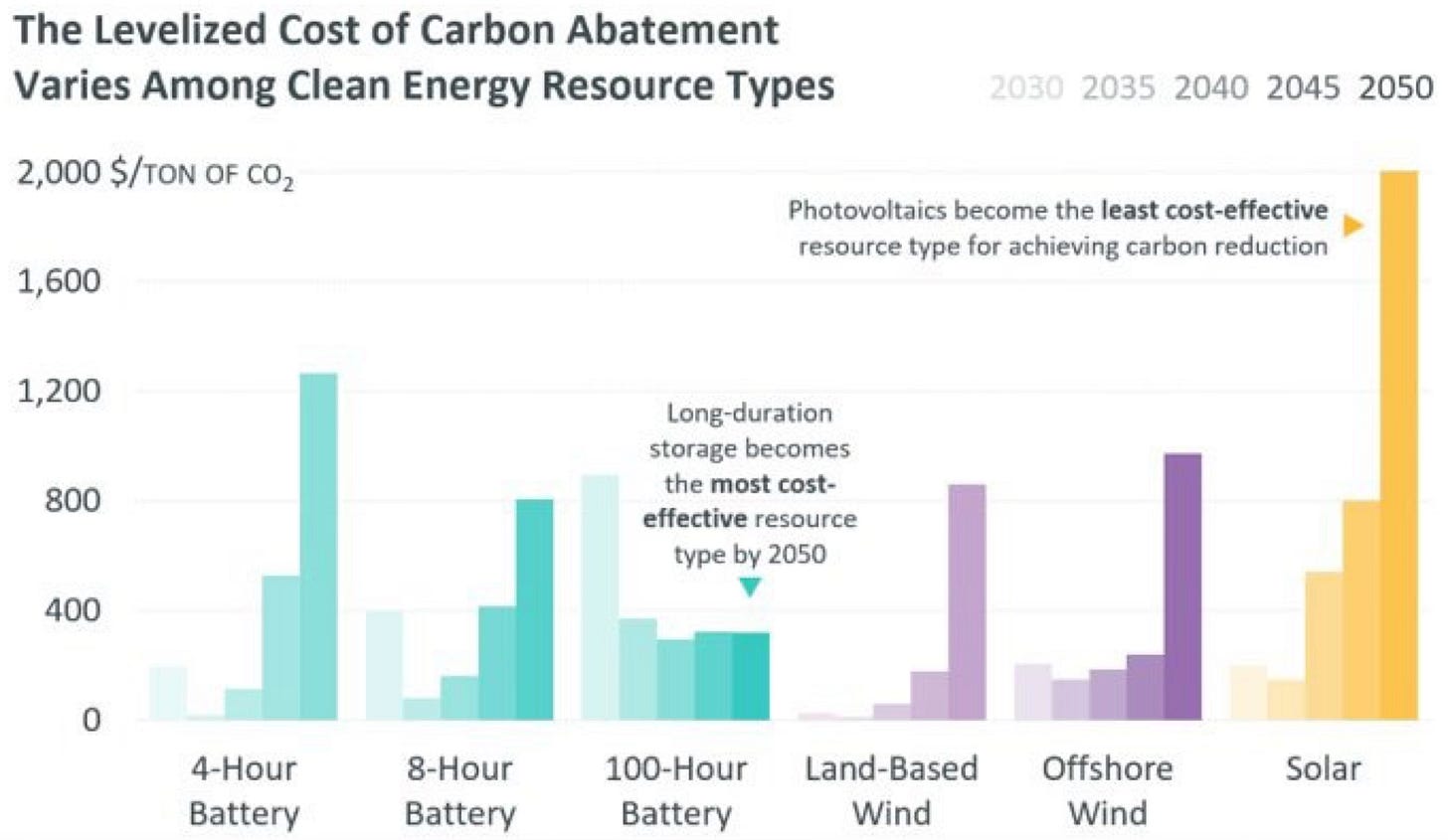

Even if we did reach this pace of buildout, ISO-NE projects that the incremental value of each new megawatt of generation will fall off a cliff by the mid-2030s. By then, the “easy” generation will be covered, so each new solar or wind system will only turn on their inverters for marginal, lower-efficiency hours.

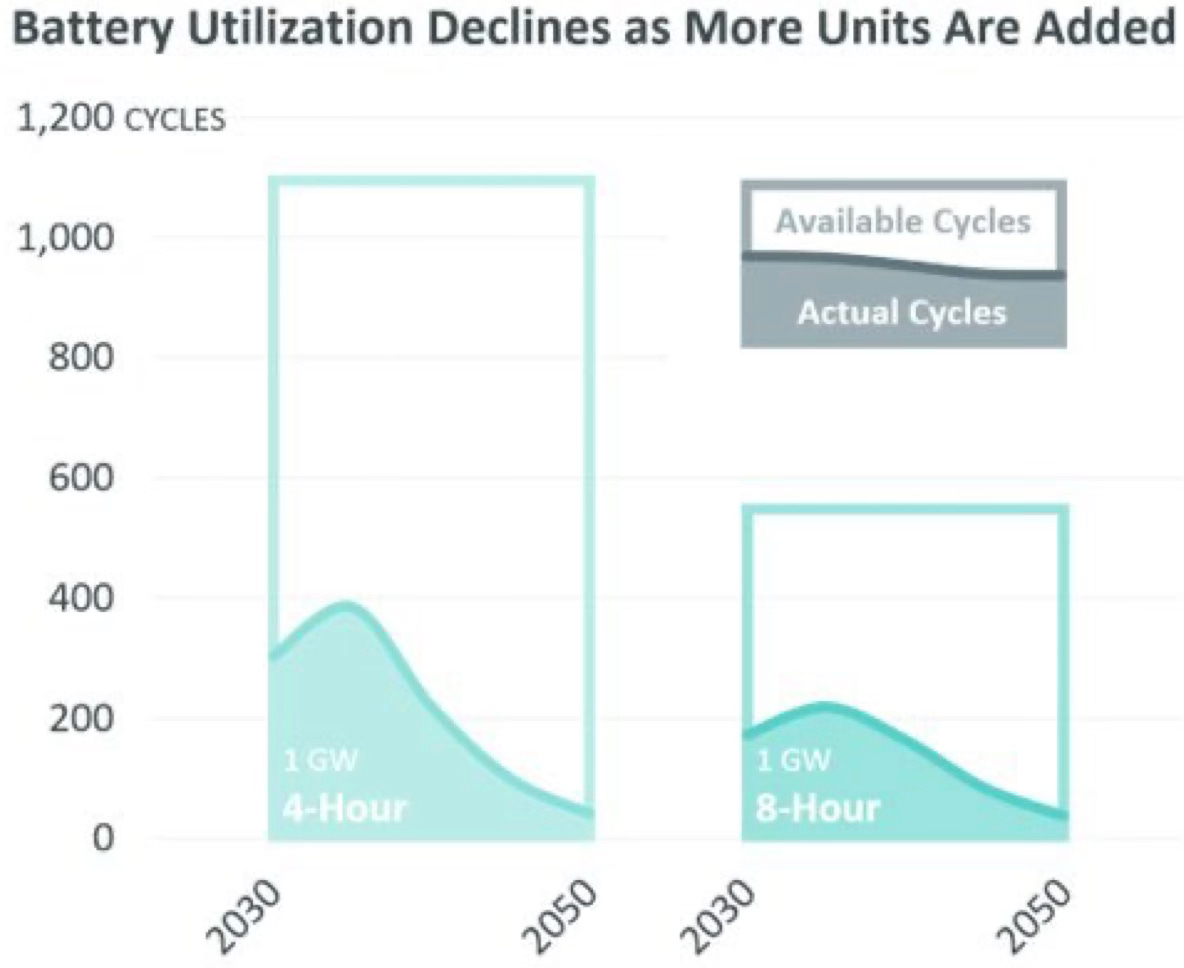

This suggests deploying energy storage to fill in those gaps. However, even the value of four- and eight-hour energy storage will start to fall as those “marginal” hours also get saturated, leaving only that last 25%, then 10%, then 5% of hours of the weakest intermittent generation chasing the most demand.

Right now, the utility industry is procuring two- and three-hour batteries. You, the reader, should think about four-hour batteries. By 2040, you ought to consider eight-hour batteries. By 2050, hundred-hour batteries will be the play. Yes, that growth in specification is exponential—ditto for generation capacity, transmission need, and ultimate cost as we approach net zero.

A Peak Demand Nightmare

Installing enough generation and storage to cover that last 5% will result in an oversupply of energy during easy generation hours…and an undersupply of energy during the last 1% of hours that really drive grid costs. As a result, the wholesale price of electricity will make increasingly dire swings from yet-lower prices when it’s especially windy or sunny to yet-higher prices during that last 1%—better known as summer and winter peaks.

Those peaks are a particular concern to ISO-NE, because they will require an increasing quantity of resources that will run for less than 90 hours per year. Those assets will be paid to sit on standby for 8,670 hours of the year, so that the capex is covered and the control rooms staffed when they are needed. But as intermittent generation and grid-reactive technologies (EVs, PowerWalls, smart thermostats on electric heat pumps) make those demand peaks larger and more volatile, that last 1% of electricity assets will define the cost and carbon output of the New England grid.

Currently, the best sources of peak-only electricity are fossil-fuel generators. In a gas-constrained 2025, those generators are disproportionately oil combustion. In a carbon-constrained 2040, they’ll likely be gas combustion. The 2050 picture likely keeps ISO-NE planners up at night.

In a 10 December 2024 webinar, an ISO-NE analyst gave some numbers to this escalation:

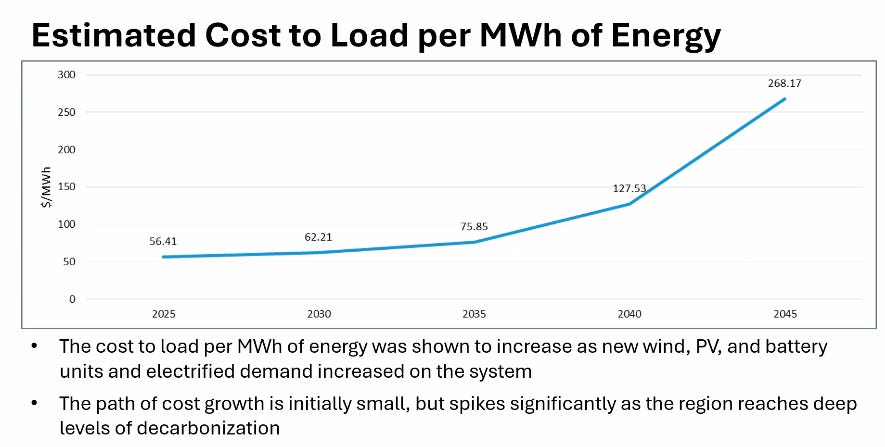

ISO-NE projects that from 2025, the price per unit of wholesale electricity—before distribution grid upgrades—will increase 2.3x by 2040, and 4.8x by 2045.

They don’t even offer a number for 2050.

The Death of the PPA

Most producers of intermittent generation won’t worry about those peaks—they will have more problems with the oversupply. The wholesale electricity market is built on twin bidding structures: generators bid low-to-high, consumers high-to-low. The point where the supply and demand meet becomes the clear price that everyone pays, no matter what they bid.

Fossil-fuel generators set their bids on the price of fuel—if the clear price is higher than their bid, that’s just gravy. But for intermittent generators, the price of your next MWh is near-zero. So, these producers bid zero dollars into the market, guaranteeing they’ll run, because they’ll actually get paid at the clear price.

But even this dance is just a formality for most intermittent generators, because their core revenue source is typically a power purchase agreement (PPA). The producer signs an agreement with a power purchaser (usually a utility), so that the purchaser pays a set price per MWh to the producer. For current intermittent generation, that price is $60-80/MWh, invoiced monthly, with few concerns about when that energy shows up.

But if only intermittent generators clear the market, then the clear price might actually be zero, which places producers in a dilemma:

Curtail generation, meaning fewer MWh for your power purchaser

Bid negative prices and keep generating

But that pushes the clear price of electricity negative, meaning generators would literally pay the market to keep generating, starting a race to the bottom that attrits away the revenue from those PPAs they signed.1

This shift will likely materialize around 2035, as wind and solar saturate the “easy” generation hours described above. At that point, new intermittent generators will need a new revenue stream—one that will pay them for MWh at a certain time.

Based on a June 2024 study by Lazard, adding 4-hour storage to an intermittent renewable resource increases levelized costs by $20-30/MWh at minimum. But that doesn’t account for all that negative-cost electricity at times of saturation.

I have no idea what the new business model looks like.

The Shaky Promise of Distributed Energy

At some point, I need to write a whole blog on distributed solar in New England—but for now, ISO-NE projects that by 2032, New England will have so much behind-the-meter solar that on some days, grid demand will sink below the output of the regional nuclear fleet. Because these nuclear plants cannot easily reduce their generation, they constitute a “minimum output” floor for the entire grid. Eventually, the hole in demand carved by distributed solar will overload the system.

We have no easy answer to this. We do, however, have a promised answer in distributed energy resources (DERs): behind-the-meter battery storage systems, plugged-in electric vehicles (EVs), load-following thermostats and industrial processes—anything and everything that can respond to grid signals in real time. You might also hear the term “virtual power plant” (VPP) in this context.

DER companies are the sexiest and most customer-facing strain of “climatech.” The pitches sound like, “If you plug your car in, it will talk to the grid, optimize charging costs with an Algorithm, transfer those savings direct to your electric bill, and solve the grid’s problems at minimal capital cost.”

There are challenges. I’ll outline three versions of that EV charger promise.

1. Install a Real-Time Electric Rate on the House

Texas will let you do this. A portion of your bill will still go to poles and wires, but the rest will track the real-time ebb and flow of the ERCOT real-time electricity market. In theory, you’d want an EV charger that reads those numbers, but the shape of the price curve is predictable enough that a customer could get away with a simple schedule. Typically, customers see serious bill reductions, even before they change their energy use.

PRO: This is simple to implement—all you need is an AMI meter. Many utilities have already deployed these.

CON: During the infamous 2021 Winter Storm Uri, customers with real-time rates got punched with five-figure electric bills. Most of the “savings” in a real-time rate come from increased risk. It’s like saving money by not paying for car insurance. And as we saw above, real-time electricity prices are already getting more volatile. Also, I haven’t seen an EV charger advertise a datalink to wholesale energy markets.

2. Install a Second Meter Just for the Car

This would insulate customers from the worst of these price spikes. A Uri situation would no longer bankrupt a customer, especially if they’re mindful enough to unplug their EV in such a situation (or backfeed it into the grid for major cash).

PRO: No $15,000 electric bills.

CON: Installing a second AMI meter, meter socket, service panel, and revised wiring for the EV charger will cost…$2,000-4,000? Per customer? There are not enough electricians to implement this at scale. And again, I haven’t seen an EV charger advertise a datalink to wholesale energy markets.

3. Integrate With the EV Charger Through Software

This is the approach that DER companies actually advertise. Effectively, the utility would operate a software layer that interacts with EV chargers via an internet link. This link can be used to implement the real-time rate above, or it could implement safer options like utility-managed charger automation or peak-only “demand response.”

PRO: No extra hardware, just software. Flexible implementation.

CON: Every EV charger brand works differently. Most brands sell fewer than ten boxes in your service territory. DER management platforms make patchwork arrangements with those brands. They nickel-and-dime utilities on API fees. Garages have trash wi-fi. Outages go unnoticed for months. ChargePoint service alternates between acceptable and infuriating. Enel X’s JuiceBox line is abandonware. Tesla goes out of their way to antagonize utilities: mucking with meters, ignoring emails and phone calls, integrating with nothing, and overall asking for forgiveness and not permission in product categories where mistakes burn houses down.

Forgive my skepticism.

Two Heresies Considered

In this study, ISO-NE considered two kinds of “dispatchable emissions-free resource” as alternate options reducing the amount of intermittent generation necessary to decarbonize the grid.

The first option is synthetic natural gas (SNG) produced from direct carbon air capture and intermittent-renewable-powered electrolysis. ISO-NE projects that 20 GW of SNG generation would reduce needed buildout of intermittent generation by 35-40 GW. They expect SNG to cost $40/MMBTU and integrate easily with existing natural gas infrastructure (whereas hydrogen would not). That price for “emissions-free” natural gas is high but functional—Europe paid as much for liquefied natural gas (LNG) in 2022. But one can also consider natural gas collected from farm waste, sewage, and landfills at $10-16/MMBTU—the price Europe paid for LNG in 2024.

ISO-NE also considered small modular nuclear reactors (SMRs), a technology I’m told will be ready by 2035. The promise is a nuclear reactor that can come off an assembly line at sizes as small as 5 MW. Based on such promises, ISO-NE projects that 15 GW of SMR generation would reduce needed intermittent generation buildout by 55-60 GW. They model the price of SMR electricity at $70/MWh, but pilot projects have deployed slowly and over budget. I suspect (Probable 55-80%) that $100/MWh is a more likely price, and I would not be shocked (Improbable 20-45%) by $150/MWh.

And that’s if we New Englanders allow nuclear energy in our hometowns.

Ultimately, ISO-NE lands on a conclusion similar to the Trump Administration’s new energy secretary. Between price, carbon reduction, and reliability, you can only pick two. In ISO-NE’s projections, strict carbon neutrality comes at a steep financial cost, but managing those costs requires some not-so-green technologies.

But to ISO-NE, reliability is non-negotiable.

Questions for the Reader

I will not make suggestions on what policymakers should do with this information. But I will offer some uncomfortable questions to consider.

Would you accept rolling power shutoffs in non-essential buildings for 2-4 hours on particularly hot summer evenings and particularly cold winter mornings?

Would you accept an electric carbon intensity of 90 lb/MWh, which is 10% of the carbon intensity of New England electricity in 2005?

Would you accept natural gas produced from direct air capture, farm waste, sewage, and/or landfills as zero-emissions fuel?

Would you accept biodiesel produced from vegetable oil, used cooking oil, or algae as zero-emissions fuel?

Would you accept a large nuclear reactor the size of Three Mile Island within ten miles of your house? Would your neighbors?

Would you accept a small nuclear reactor the size of 2-5 house plots within a mile of your house? Would your neighbors?

If you answered no to all of the above, would you accept a 10x increase in your electric bill by 2045?

If you answered no to the above, would you consider spending $100,000-200,000 on a solar-storage system that would let you remove your electric meter entirely?

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not reflect those of their current or previous employers or any elected officials. The author makes no recommendations toward any electric utility, regulatory body, or other organization. While certain information contained herein has been obtained from sources believed to be reliable, the author has not independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author assumes no liability for this information and no obligation to update the information or analysis contained herein in the future.

This is starting to happen in Europe, although I hesitate to draw any parallels between their market and ours.

As you aluded to though, no one is going to build solar w/o a PPA due to the loss of revenue at high output hours, but who in their right mind is going to issue a PPA unless they can both control entry to manage how much excess they have to deal with or dispose of, and rate set to recover the fixed overall costs?

Overall I think its more that storage as a whole has not been figured out yet. I think the issue may be they are trying to treat storage as a generator rather than a grid asset.

Storage just loves in time, rather than space.

Interesting!

On what might replace PPA's:

https://x.com/Ember421/status/1720198113393070287?s=19

Broadly, I don't think a market oriented system can either deeply decarbonize or get high reliability using intermittent or negligible marginal cost resources...

This is my most 'market' version I think could work. Or you could just be Hydro Quebec...