ISO-NE is Already Planning for Black Swan Events

You should have been doing this since COVID ngl

In early 2024, ISO-NE submitted some changes to their Financial Assurance (FA) Policy1 for their capacity markets, which were then instituted 1 June 2025. The updates are related to the current structure of Capacity Supply Obligations (CSOs), which I dug into in this article:

Particularly, ISO-NE worries that with a sufficiently bad Capacity Scarcity Condition, some power plants might botch their CSOs so badly, and pay so much in penalties as a result, that they’ll default on those penalties or (worse) go completely insolvent. ISO-NE says they ran some numbers on this and concluded this is a serious risk to the grid. So starting 1 June 2025, ISO-NE started running corporate liquidity assessments on all companies holding any CSO. If I heard properly, this means ISO-NE is rifling through companies’ quarterly financial statements to ensure they have enough cash on-hand for a credit standard ISO-NE sets at their own discretion.

To be fair, there was already an FA Policy on the books. And if ISO-NE determines you to be a “Low” credit risk, they won’t change your collateral requirements. But if you’re a “Medium” or “High” credit risk, you’re getting smacked with additional collateral requirements if you still want your capacity payments. And ISO-NE is tracking your line of credit, too. If your bank’s credit rating falls below A-minus, ISO-NE is drawing down your line of credit. If that line-of-credit expires next month, ISO-NE is calling to collect. If your money is at Capital One, you’re screwed. If you’re with Citizens or M&T, you’re on thin ice. If you have a portfolio of capacity resources, you might be able to pool your collateral requirements and save a bit. That sounds like another reason to consolidate in a likely Year of Consolidation.2

Power plant owners are complaining—primarily because no one likes being told to eat their financial vegetables (risk management), but also because the process of adjusting the FA Policy has been…messy. Apparently, the team that handles credit at ISO-NE has competency shortfalls,3 and the ISO-NE Tariff as of 28 Feb 2025 is 123 pages long.4 No one, I was told, understands the whole thing. Even if ISO-NE was on the ball, there are too many knock-on effects from adjusting a policy that was first written ten years ago, when the projected incidence and cost-per-kW-month of catastrophic peak events were much lower. I asked if a power plant owner has ever defaulted on a CSO penalty. And I was told no.

ISO-NE is adjusting their Financial Assurance Policy to mitigate financial crash-outs that have not happened in New England.

…Or Is It “Not Yet?”

But this financial storm did happen in PJM Interconnection, the RTO/ISO that manages the grid for much of the Midwest. Winter Storm Elliot, which hit around Christmas Week 2022, hit PJM hard. The lights stayed on, but a lot of power plants failed to run during that time, leading to Non-Performance Charges totaling almost $1.8B. From what I heard, a few power plant operators actually went bankrupt as a result. These operators filed complaints with FERC, claiming that PJM screwed up their tariff and emergency actions, and the issue got settled in September 2023 with mitigated penalty payments. I suspect this is a key (but not singular) factor in why capacity prices in PJM have suddenly shot through the moon.5

ISO-NE, clearly, wants to get ahead of this nightmare. One could say that so far, New England has gotten lucky. I don’t think PJM and ERCOT are necessarily worse-managed than ISO-NE, so if a bad winter storm can snap those markets like a Slim Jim, it stands to reason that the same can happen in New England.

ISO-NE is planning ahead—and not just on financial risk.

Enter the Probabilistic Energy Adequacy Tool (PEAT)

I briefly mentioned the Probabilistic Energy Adequacy Tool (PEAT) and its associated Regional Energy Shortfall Threshold (REST) in my article about the Inventoried Energy Program:

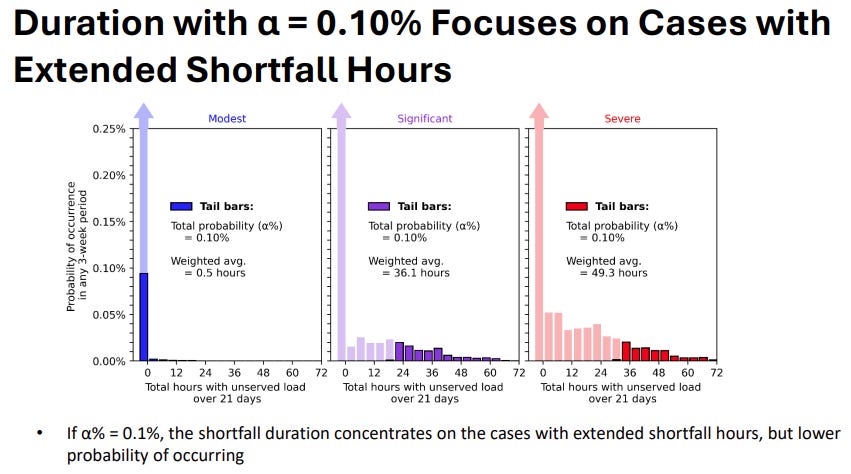

The PEAT is a software tool designed to assess a question that really was unanswered when the infamous Mystic Generating Station announced its retirement in 2018: Should the Big One arrive in New England, how screwed are we? To answer this, ISO-NE has set up a scenario builder that models the worst three-week windows they can think of and asks:

Would we run out of electricity and have an energy shortfall?

How much would this energy shortfall be? For how long? At what likelihood?

What would this do to customers? Would there be brownouts? Blackouts?

To this end, ISO-NE has two REST thresholds in mind: a magnitude-of-tail risk, and a duration-of-tail risk. As of April 2025, ISO-NE has come up with numbers for these risks at a variety of system stress levels. For the Winter of 2027, ISO-NE projects we’ll be okay, with:

A 0.00001% chance of any energy shortfall

A 0.4% chance of a shortfall duration longer than 0.0001 hours (0.36 seconds).

But as that system stress increases—primarily due to increased load from EV charging and electric heat pumps, the risk of shortfall increases, too:

But saying there’s a 0.00001% chance of system collapse is a joke out of Jimmy Neutron. To model tail risks reasonably, you need to pick a real risk threshold—and in ISO-NE’s case, they pick a 0.25% risk of energy shortfall over a given 21-day window. This comes out to one shortfall per 90ish seasons, or one shortfall per 21 years. Of course, that risk of an energy shortfall is not evenly distributed—it’s almost certainly going to land on a cold, dark winter morning.

And it’s up to ISO-NE to decide how bad a brownout they’ll accept on a once-per-twenty-years timeline. Make too stringent a requirement, and they demand hundreds of millions in investment that will never pencil out. Make too lax a requirement, and they get the electric infrastructure equipment of driving without car insurance. ISO-NE CEO Gordon van Welie does not want to be in the hot seat for some Winter Brownout of 2029, because that will kill 1-3 people unless we’re prepared. Ultimately, they settled on a target maximum shortfall of no more than 3% under-powering during no more than eighteen (non-contiguous) hours over a three-day window.

It’s a number; I wouldn’t have done any better.

Tail Risks Are the Name of the Game Now

Ultimately, everyone in the electric utility industry will be forced to re-assess—and make financial decisions on—their 5%, 1%, and <1% tail risks. I know it’s a funny meme that we’ve been in Unprecedented Times™️ for five-plus years now, but we genuinely are in the jungle now. It is now painfully clear that:6

Global supply chains are far more fragile than we expected in 1999.

The “flat world” of global free trade is collapsing into a colder world of regional spheres of influence.

The initial effects of anthropogenic climate change are an increased incidence and severity of tail-risk weather events—the particular events being specific to your location.

The new era of distributed energy resources (solar, storage, EVs), distributed warfighting technology (drones, information warfare, OSINT, stochastic terrorism), distributed information systems (blockchains, cloud, AI, social media), and distributed financial tools (amateur trading platforms, crypto, deglobalized financial markets) means that your catastrophic threat vectors—yours, the reader’s, right now—are increasingly cheap, hidden, numerous, and stupid.

In the past ten years, a lot of new catastrophic scenarios have become 1% likely, or 0.25% likely. And you must plan for these contingencies, because they will have impacts on your system reliability, cost structure, and regulatory compliance. I’m not saying you should plan for nuclear war7 so much as:

Deep energy shortages: brownouts, blackouts, $1000s/MWh wholesale prices, ISO-NE market failures, cascading bankruptcies

Economic collapse: the US defaulting on debts, 10%+ inflation, 10%+ Fed rates, mass bill delinquency, vendors going out of business, economic “lost decades”

Regulatory collapse: overturned legal precedents, legislative 180s, FERC commissioners getting fired, state seizure of investor-owned utilities

Wild variability in all commodity prices: oil (WTI Cushing) ranging between $30/bbl to $150/bbl, gas (Algonquin CityGate) between $1/MMBTU to $30/MMBTU, not to mention price swings in copper, steel, aluminum, silicon, and battery metals

Supply chain shortages: transformers, switchgear, vehicles, company laptops, staff, answers

Security threats: ransomware, state-sponsored espionage, kinetic attacks on infrastructure, assassination attempts on leadership, assassination and kidnapping attempts on key experts, war with China starting with cyberattacks on utility IT systems because you are already compromised

To be clear, there is massive upside potential too. But electric utilities are neither designed nor asked to leverage it. Electric utilities, whether municipal or investor-owned, are hedges on the economy. Investors buy equity in utilities for guaranteed slow returns. Electric commissioners protect municipal independence because they’re even more bearish than the investor-owned utilities. Hell, I work for a municipal electric utility in New England, the final redoubt of what remains of old WASP culture, in a role too useful to gulag, specifically as a hedge on the American project.

Electric utilities hedge. It’s what we do. But the risk profile has deepened. The “smart” hedges of 2005 are cooked. You need to embrace grid automation, predictive modeling, distributed energy, hardened physical and cyber security, smarter inventory management, and such because that’s now the risk-averse thing to do. I know it feels risky to drop a couple million dollars on feeder-level battery energy storage systems that enable short-term islanding of critical infrastructure, but in April, all of Spain and Portugal crashed into a total blackout because the local grid operator fumbled their dispatch operations. Or something; the report only came out last week:

FILE: Translation of Spanish Government Report on 28 April Iberian Blackout

This is a PDF for a Claude translation from Spanish to English. There might be an genuine English copy floating around.

How much would you pay to keep your local police station, fire station, and water treatment running for twenty-four hours? Or to zap a drone carrying a bomb to your substation? Or to wait out another COVID-scale supply disruption? Or to weather ten percent of your customers defaulting on their electric bills?

And here’s the kicker—at what point does the price to prepare against catastrophe outweigh the cost of letting the catastrophe happen?

This post and the information presented are intended for informational purposes only.The views expressed herein are the author’s alone and do not reflect those of their current or previous employers or any elected officials. The author makes no recommendations toward any electric utility, regulatory body, or other organization. While certain information contained herein has been obtained from sources believed to be reliable, the author has not independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author assumes no liability for this information and no obligation to update the information or analysis contained herein in the future.

ISO-NE abbreviates this to FAP. I have ingested too much greentext to adopt this terminology.

Not a bad time to pivot into murders and executions mergers and acquisitions.

That said, they aren’t as wracked by ISO-NE’s nightmare staffing shortages:

The FA Policy as of 1 Feb 2025 is another 103 pages!

Pour one out for Manu Asthana by the way; poor guy’s had a bad time as CEO of PJM.

I am aware that to most people, this is not clear. I will keep repeating this until I make it clear.

Although that is increasingly on the table, in multiple theaters.