What Was ISO-NE's Forward Capacity Market?

The Planned Economy, Part 1: Background

In February 2024, the Independent System Operator of New England (ISO-NE) ran its 18th annual Forward Capacity Auction, securing commitments of 31.5 GW of electric generation in anticipation of a projected electric peak demand from 1 June 2027 to 31 May 2028.

It was the last of its kind. Starting in 2024, ISO-NE plans to rebuild its capacity market from the ground up in time for 1 June 2028. In fact, they intend to work on these Capacity Auction Reforms at the expense of almost all other market planning activities, debilitating staff shortage be damned.1 Unfortunately, explaining ISO-NE’s plans and why they matter requires explaining:

What electrical capacity is

How the current Forward Capacity Market works, and

How it fails

…And that’s a tall order. I’ll do my best, but if you have questions, please comment on them so I can provide clarification.

Aside: Utilities (Mostly) Don’t Own Power Plants

Before I go too far, I want to bring up a foundational fact I forgot was not obvious: Electric utilities in New England, for the most part, do not own power plants. The two exceptions are Vermont utilities, which remain vertically integrated, and municipal electric utilities, to which regulators allow a longer leash. But outside these exemptions, the organizations that run poles and wires are not the organizations that own power plants.

Instead, power purchasers (utilities) buy electricity as a commodity from power producers. ISO-NE builds, maintains, and runs the relevant markets as part of its mandate.

What is Electrical Capacity?

When you pay your (residential) electric bill, your utility bills you based on how much electrical energy you used, in kilowatt-hours (kWh). That bill doesn’t depend on when you use that electricity.2 However, ISO-NE cares more about instantaneous electric demand: the rate at which electricity is running from electric generators, through transmission and distribution lines, to customer end uses at this particular moment. This is typically tracked in megawatts (MW), for which 20 powers a town during pleasant weather.

The electrical capacity of the grid is the maximum demand that it can supply at any given time. In some places, it’s limited by the transmission lines, but at ISO-NE’s scale, the primary limiting factor is generation capacity. For the 18th Forward Capacity Auction, ISO-NE secured guarantees for 28,471 MW of electric generation, 465 MW of imported electricity from New York or Canada, and 2,614 MW of other demand resources.

Not all of that capacity runs all of the time. For example, on 17 March 2025, only 14,322 MW was needed at the local peak time of 7:10 PM, and at the demand minimum of 3:45 that morning, New England only needed 9,273 MW. There were likely several generators that ran at 7:10 PM that didn’t run at 3:45 AM. And the real-time market reflects this: when there was low demand at 3:45 AM, the “hub” spot price of electricity was $32.03/MWh. When there was high demand at 7:10 PM, that price was $45.42/MWh. Because higher demand typically leads to higher electricity prices, it’s possible for a power plant to still make money even if it only ran for half of the day.

But what about the approximately 7,000 MW of generation that didn’t run at all on 17 March? Particularly, what about those last few generators that run only for the 100 hours of the year with the absolute highest demand? They don’t run long enough to make back their expenses just on electricity sales, but the grid still needs them.

How do you make sure these “peak time” plants—peaker plants, in the lingo—make enough money to stay online when you need them? ERCOT in Texas likes scarcity prices, but New England instead ran a Forward Capacity Market.

What was the Forward Capacity Market?

According to environmental activist group No Coal No Gas, the Forward Capacity Market (FCM) was a means of subsidizing fossil fuel generation that puts the lie to ISO-NE’s nefarious branding as a “neutral” party in the New England grid. In practice, it’s a means of keeping peaker plants alive. Some plants were designed as peaker plants, like the quick-starting single-cycle Northeast Reliability Center in Peabody, MA.3 And some are old and inefficient plants that are simply too expensive to run all the time, like the now-closing Merrimack Station coal plant in Bow, NH. If you’re uncharitable, you can characterize the FCM as a way to pay creaky old power plants not to run, but now that you know what peak capacity is for, you can understand why we ratepayers pay for it. We need them for those last 100 hours.

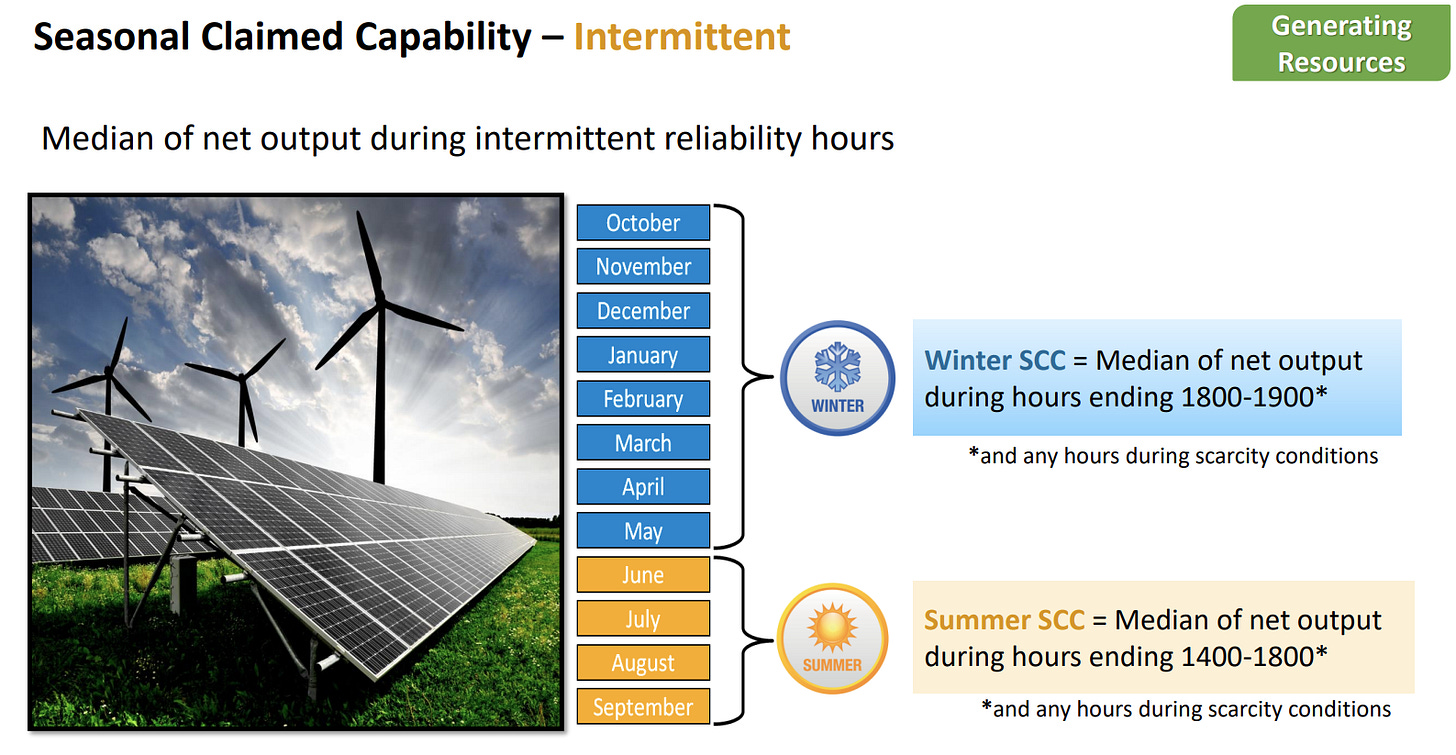

The FCM ran every February for a Capacity Commitment Period (CCP) three years in advance. Prior to the auction, resource owners submitted how much seasonal claimed capacity (SCC) they could commit to the grid. Note that SCC wasn’t necessarily the nameplate output of a given plant. Instead, it’s the amount of generation that it could more-or-less guarantee during the times that the grid needs the extra juice. As an example, the winter SCC of a solar farm is near-zero. During peak times and scarcity conditions—7AM or 6 PM during a cold snap—the capacity value of a solar plant is negligible because the sun is not out.

Then, once all the bids are vetted, ISO-NE runs what they call a descending clock auction (DCA). In this structure, bids are placed in rounds. Imagine:

In Round 1, ISO-NE asks, “How much SCC will people sell me at $6.00 per kW-month?”4 A bunch of hands go up. That’s too much capacity.

So in Round 2, ISO lowers the number. “How about at $5.00 per kW-month?” Some of the hands go down. Still too much capacity.

“How about $4.00?” More hands go down. Still too much.

“…How about $3.58?” Yet more hands go down, but now there’s enough capacity. Sold.

In practice, this auction is run by a software platform. Like everything else ISO-NE does, the Forward Capacity Market is a “competitive market” that is held together by complex forecasting algorithms, software-mediated guardrails, and teams of eggheads vetting every input. It’s a planned economy trying desperately to balance the benefits of market competition against the inherent challenges of making a market out of something as intangible, capital-intensive, and societally necessary as electricity.

The Ballad of Mystic Station

Unfortunately, this market methodology failed in one particular, spectacular vignette: the closure of the Mystic Generating Station. This was a massive generation complex that included a pair of natural gas units that could produce up to 1.4GW together, a few smaller peaker units, and one of two LNG import stations in New England.

But it’s been a financial hot potato since it was built in the early 2000s. It’s changed hands six times in its twenty-year history, and I don’t think it’s ever made money. In March 2018, the project gave up, and in 2019 it dropped out of the Forward Capacity Auction for the 2022-2023 capacity year. But at the time, ISO-NE thought New England would face brownouts without Mystic, even if the plant didn’t make money. They could force it to stay open, but they needed to pool the funds to make it whole. That pool ended up including 91% of the operating costs of the associated LNG terminal, resulting in a legal battle that included one Commissioner on the Federal Energy Regulatory Commission (FERC) arguing that FERC was ordering ratepayers to “bail out” this facility.

Would changes to the Forward Capacity Market have prevented this from happening? I don’t know. But those must-run payments to Mystic were steep,5 and the prevailing vibe among insiders is that everyone got scammed. But ISO-NE don’t really care if they were scammed—it’s not their money. For them, Mystic was a wake-up call for resource adequacy, for running out of generation in the winter, for impending brownouts, if they didn’t fix things.

The Forward Capacity Market Needed to Change

The fall of the Mystic Generating Station may have been the wake-up call, but the FCM is proving increasingly out-of-date for more reasons as well.

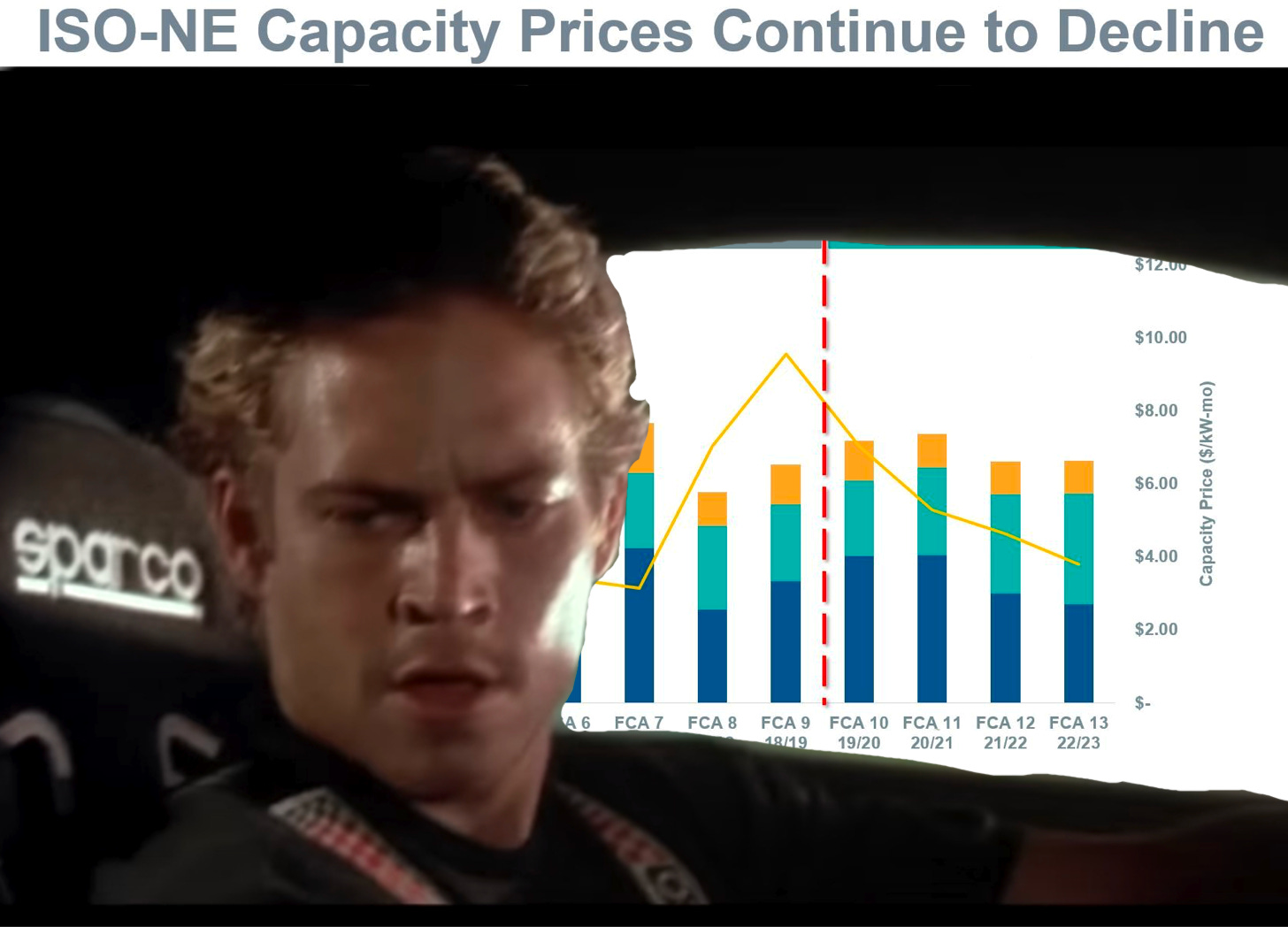

Problem 1: Low Payouts for Intermittent Renewables

Let’s run some numbers on it. Based on normalized generation data I have from a few PPA solar projects, a 10 MW solar system would manage a winter SCC of 500 kW over eight months and a summer SCC of 5 MW over four months.6 At a capacity cost of $3.50/kW-month, that comes out to…

That’s $84,000/year in capacity payments. For context, this hypothetical 10 MW system probably costs $15-30 million to build. These capacity payments are a rounding error to the system’s business model. To a renewables shill, this proves that the FCM has an unfair bias against renewables. To ISO-NE, I suspect the problem is that intermittent-storage systems don’t have a good business model within ISO-NE’s capacity and reserve markets.

Problem 2: Seasonal Divergence in Capacity Needs

Winter and summer capacity costs increasingly operate by different rules of engagement. Particularly, the limitations on gas supply and solar generation in the winter mean that the resources needed to maintain capacity in the winter are not necessarily the same resources that can maintain capacity in the summer.

In the summer, gas peakers and big solar farms will probably do just fine. In the winter, we might still be stuck with oil. But do we really want to pay for two different fleets of capacity resource to exist?

Problem 3: A Three-Year Promise Guarantees Nothing in 2025

The Forward Capacity Market runs auctions three years forward because ISO-NE expects prospective suppliers to take their cleared bids, hand them to a lender or investor, and say, “In three years, I will make this amount of money, guaranteed. Give me money to meet this commitment.”

In an era of fast construction timelines and stable fuel costs, this makes sense. But in 2025, it does not take three years to build new capacity. For wind, it takes ten years. For solar, it can take 18-24 months. For storage, you can get it done in a year if you’re fast, but by year three you’re reconfiguring it because the peak dispatch window is now five hours instead of the three hours you built around. And fossil fuels aren’t any more financially reliable—the gas traders I follow on Twitter are all schizo-posting out of panic, because none of them know what the market is doing.

This Is the Most Complicated Thing That Could Ruin Your Life

With all this in mind, ISO-NE has told FERC that they plan on rebuilding their capacity market from scratch. They’re going to do in two stages: the Prompt stage in 2025, and the Seasonal stage in 2026. If FERC approves both of these filings, ISO-NE plans to spend 2027 implementing these reforms as a series of Windows-XP-looking software tools, so that in Spring 2028, they can run the first prompt-and-seasonal capacity auction in time for 1 June 2028.

If things go to plan, this will consume ISO-NE’s market design resources for the next three years and potentially drive 2-5 reedy economists to a Lovecraftian depth of madness. If these reforms drift more than three cumulative months behind schedule, or—worse—if FERC rejects one of these filings, then the New England grid will find itself held together by duct tape and twine during the 2028 elections for the Governors of Vermont and New Hampshire, 3 New England Senators, and the next President of the United States.

If the Capacity Auction Reforms fail, ISO-NE will, in Summer 2028, release several restrained reports about insufficient resource adequacy for the winter of 2028-2029. That will snowball into an unfortunate election-runup headline:

New England Does Not Have Enough Electricity for the Coming Winter

Understanding that headline requires understanding the outgoing and incoming ISO-NE capacity markets. And there are no resources explaining them.

Except for this post you just read.

This is the first of a three-part series. Read on here:

ISO-NE Wants to Sell Capacity Faster

Last week, we talked about ISO-NE’s capacity market, which they plan to rebuild from the ground up in the next three years, using all of the understaffed egghead brainpower they have left:

ISO-NE Can't Say No to Their Stakeholders

If I had to pick a timeframe for when the Old Grid of the ‘00s and ‘10s died, I would pick the back half of 2017. During that time period, the Tesla Model 3 started deliveries, soon becoming one of the best-selling vehicles on the planet, while Hurrican Maria flattened Puerto Rico’s electric grid. Maria was the first natural …

This post and the information presented are intended for informational purposes only.The views expressed herein are the author’s alone and do not reflect those of their current or previous employers or any elected officials. The author makes no recommendations toward any electric utility, regulatory body, or other organization. While certain information contained herein has been obtained from sources believed to be reliable, the author has not independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author assumes no liability for this information and no obligation to update the information or analysis contained herein in the future.

By the way, that staff shortage is still bad:

The exception is customers with “time of use” rates.

To non-glowies, this is the infamous Peabody Peaker Plant.

The unit cost for both capacity and transmission is dollars per kilowatt per month, or $/kW-month. Yes, electric utilities use deranged units. We are engineers, not physicists.

We’ll talk more about this in two weeks.

The winter SCC was calculated as the projected generation in kW from October to May (8 months) between hour-ending 6 PM and hour-ending 7 PM. The summer SCC was calculated as the projected generation in kW from June to September (4 months) between hour-ending 2PM and hour-ending 6 PM.

Is "median of net output for hours:" even an adequate metric for highly correlated resources?

For uncorrelated resources, the central limit theorem applies, and you can assume that the actual distribution of all the plants will be tightly clustered around the median. Stick on an X% margin to cover that remaining variability and call it a day.

But highly variable and correlated resources don't work that way, they act like a single continuously variable resource, so the distribution is far, far broader...

Always surprised to read about economic planning in the US. With energy planning it's hard avoid, but maybe this is an iconic example of why we don't like economic planning in the US. There's some vision where generation and distribution magically materialize to meet demand