2025 Energy Predictions: Mid-Year Check-In

Holding myself to account

I started 2025 with a two-part set of predictions for the year: eleven quantitative predictions, and a broader narrative that I saw incoming:

I think these predictions have held up reasonably well for bets made before Trump’s inauguration. Let’s take stock.

The Quantitative Check: Mostly In Play

ALMOST CERTAIN (95-99%)

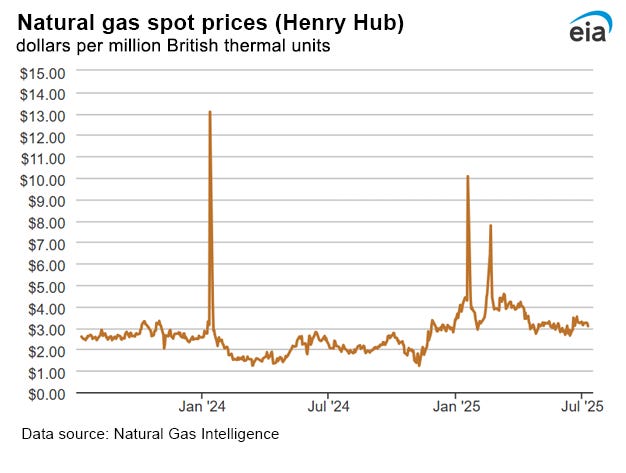

The dry natural gas daily spot price measured at the Henry Hub will not fall below $1.60/MMBTU during 2025. ⚠️ STILL LIVE

I deliberately picked a very low price floor to hedge my bet, but so far, gas prices have proven far higher than I expected. Wholesale 2025 prices have—so far—flown at about double their equivalent prices twelve months prior.

HIGHLY PROBABLE (80-95%)

The Trump Administration will attempt to increase production through executive action. ✅ CORRECT

The Second Trump Administration has certainly tried to increase oil and gas production. Early on, the Administration tried executive action. Those executive actions returned some permitting streamlining from the Interior Department, as well as a new round of leasing for offshore oil and gas drilling. Comments for that leasing round came in June—oil and gas companies are interested, but they’re worried about cost increases from tariffs.

And most importantly, the President is Truthing so hard on Truth.Social, the publicly-traded company running tremendous numbers as DJT 0.00%↑:

To The Department of Energy: DRILL, BABY, DRILL!!! And I mean NOW!!!

Donald J. Trump, United States President. 23 June 2025, 9:37 AM

I suspect the President is still looking for the lever Obama used labeled GLOBAL OIL PRICE CONTROL. He’s looking in the West Wing, but it’s really in some Crystal City studio rented to a “Yuri Andropov.”

Annual oil and natural gas production in 2025 (as reported to the EIA) will be flat-to-negative (-20% to +10%) versus 2024. ⚠️ STILL LIVE

As of early July, we have June 2025 reporting…which only gives us estimates out to April 2025. Per EIA’s estimates of U.S. field production of crude oil and U.S. natural gas gross withdrawals from all wells, we’re looking at 1.5-ish% increases in topline fossil fuel production. That, in my book, counts as flat production relative to last year.

Future signals look bearish, too. The Dallas Federal Reserve runs quarterly surveys of oil and gas firms in the Texas/Louisiana/New Mexico area, and their Q2 2025 survey suggests that firms are for the most part holding steady on 2025 drilling goals or scaling back a bit. The survey suggests that new tariffs have increased drilling costs by 4-ish% and that water management challenges have constrained production slightly. The respondents aren’t happy campers right now—the instability in DC has made the whole oil and gas market less friendly.

Firms in the area expect both West Texas Intermediate (WTI) crude oil and Henry Hub dry gas1 to trend slightly upwards through 2025.

The WTI crude daily spot price measured at the Cushing, OK hub will not fall below $65/bbl during 2025. 🚫 WRONG

Between Trump’s “Liberation Day” tariff barrage and the Israeli-Iranian “Twelve Day War,” West Texas Intermediate (WTI) Free-on-Board (FOB) crude oil at Cushing, OK traded below $65/barrel. I didn’t expect those tariff threats to crash oil demand so suddenly. And as I’ll discuss below, I expected a conflict over the Persian Gulf to increase oil prices far higher than what we saw.

Trump Administration tariffs and the attendant supply chain shifts will increase the 2025 per-kW price of solar photovoltaic panels, wind turbines, and lithium-based battery energy storage by 20-50% relative to 2024 prices. 🚫 WRONG

Per Lazard’s LCOE+ 2025 report, utility solar capital costs fell 13-26%, offshore wind costs shifted -12% to 9% (the cost range narrowed at both ends for 2025), and the cost of a 100 MW / 400 MWh utility storage system rose 8-36%. Manufacturing and mineral prices fell, confounding my prediction that tariffs and trade wars would increase prices.

Does Lazard’s report account for “Liberation Day?” I’m not sure. But I don’t have better data.

At least some New England solar and/or wind RFP responses in 2025 will exceed $100/MWh. ✅ CORRECT

I’ve seen it.

The Federal Funds Effective Rate will not fall below 4% in 2025. ⚠️ STILL LIVE

The Effective Federal Funds Rate (EFFR), per the St. Louis Fed, has held at 4.33% since January 2025.2 The President would like this to change:

A new Study by the Council of Economic Advisers (CEA), led by Highly Respected Chair, Dr. Stephen Miran, has found that Tariffs have had ZERO IMPACT on Inflation. In fact, the Study shows that Import Prices are actually DROPPING, just like I always said they would. The Fake News and the so-called “Experts” were wrong again. Tariffs are making our Country “BOOM.” Many new Factories, Jobs, and TRILLIONS OF DOLLARS in Investments are pouring into the U.S.A. Someone should show this new Study to “Too Late” Jerome Powell, who has been whining like a baby about non-existent Inflation for months, and refusing to do the right thing. CUT INTEREST RATES JEROME — NOW IS THE TIME!

Donald J. Trump, United States President. 8 July 2025, 3:08 PM

The Federal Reserve Board, for their part, still have concerns about inflation and economic uncertainty, per their June meeting minutes. I don’t see either concern dissipating in the near term.

ROUGHLY EVEN (45-55%)

At least one of Ocean Winds NA (SouthCoast Wind), Avangrid Renewables (NE Wind 1), or Avangrid/Copenhagen Infrastructure (Vineyard Wind 2) will back out of their offshore wind agreement, citing equipment price increases. ⚠️ STILL LIVE

SouthCoast Wind’s last announcement was 25 October 2024. New England Wind 1’s last announcement was 6 September 2024. Vineyard Wind 2’s last announcement was 20 December 2024. The long silences are ominous, but none of them have fully backed out…yet.

HIGHLY IMPROBABLE (5-20%)

The WTI daily spot price measured at the Cushing, OK terminal will exceed $100/bbl during 2025, because of military action. ⚠️ STILL LIVE

Iran’s air defense has been degraded since October 2024. In the original quant predictions, I named that Israel may launch air strikes on Iranian assets. And then it happened in June 2025.

But even as warplanes screamed over Iraqi airspace, WTI did not exceed $76/bbl, much less $100/bbl. Granted, no one struck Iranian oil infrastructure. Tehran threatened to close the Strait of Hormuz, but as People's Art of War explains, Iran has limited incentive to follow through on such a threat.

I’m strongly inclined to mark peak WTI already, but the past six months of foreign policy suggest I should not.

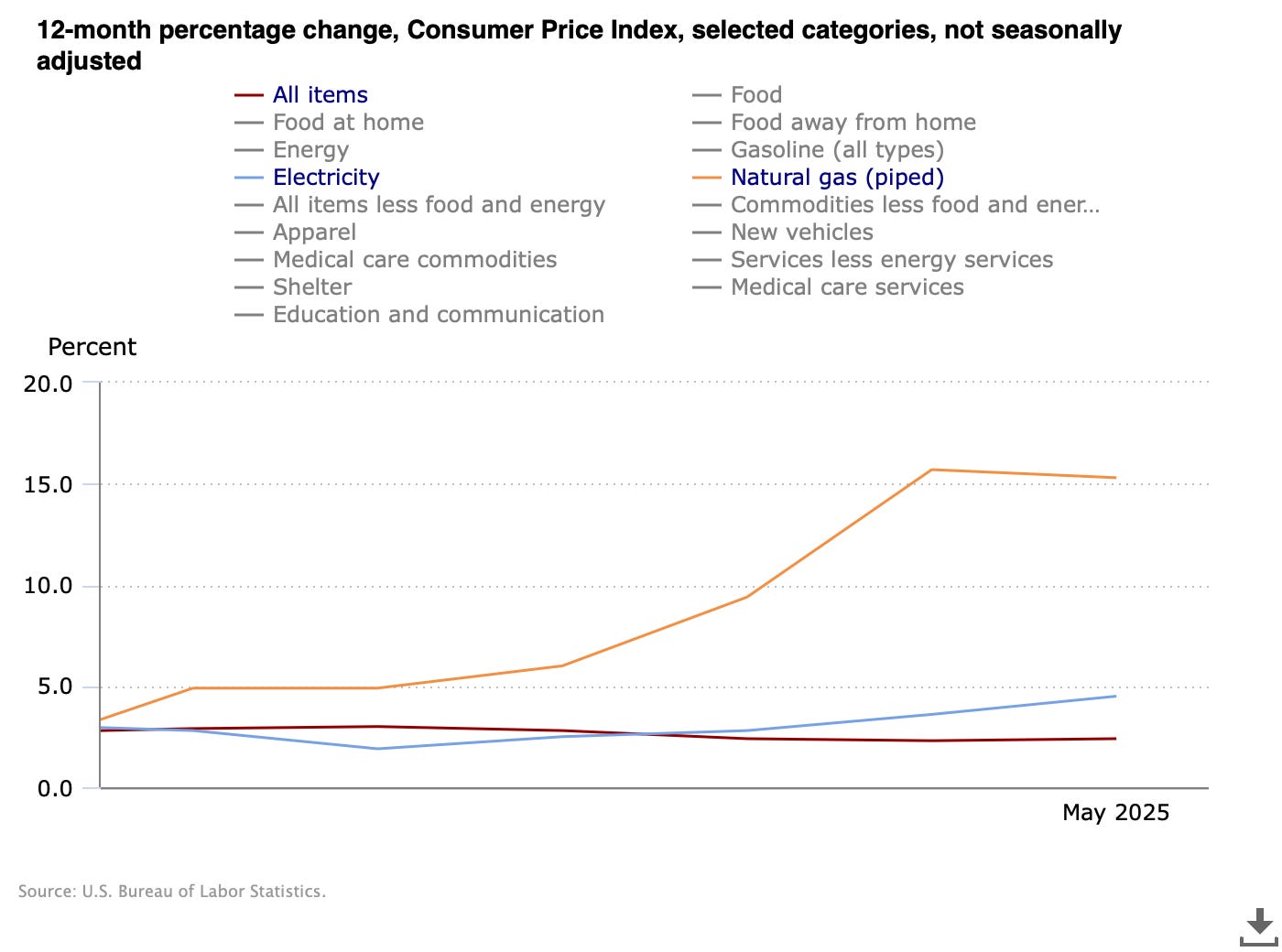

The American economy falls into recession, as a consequence of the 12-month Consumer Price Index (CPI) rising above 8%. ⚠️ STILL LIVE

Per the Bureau of Economic Analysis (BEA), the United States saw a GDP decrease for Q1 2025. If BEA finds another GDP decrease for Q2 2025, then we’re “officially” in a recession. To this end, BEA will release an advance estimate 30 July and a second, more reliable estimate 28 August. Peter Zeihan thinks the United States is already in a recession, but he’s tracking industrial investment as a leading indicator.

But I didn’t bet there would be a recession—I bet that there would be a recession because of inflation. And per the Bureau of Labor Statistics, the Consumer Price Index (CPI) has hovered around 2-3% from January 2025 to May 2025.

If the first half of 2025 proves to be a recession, I will mark this prediction as incorrect. For these longer-shot predictions, I can’t simply say “I knew this would happen”—without a counterparty to weight odds, I need to get the prediction and a projected reason correct to claim a win.

REMOTE CHANCE (0-5%)

The Trump Administration 1) successfully remove Jerome Powell from office in 2025, then 2) installs a partisan Fed Chair, who 3) reduces the Federal Funds rate to 2.5% or below, which 4) returns a 12-month CPI rising above 10% within 2 quarters. ⚠️ STILL LIVE

Should the President try, Congress will not stop him.

The Narrative Check: Mercantilists Led by Idiots

I was correct to name American Mercantilism as the ascendent ideology of 2025.3 The political energy is in the Trump-aligned right, in #reindustrialize, in vaguely Catholic (and sometimes Orthodox) shows of manhood, in the eight-way jockeying of Mad King Trump’s court. It’s America Over All, If Only We’d Do So:

The brief: devote as much land as possible to agriculture, mining, and manufacturing; cut your imports to the bare minimum of raw commodities; keep all your currency at home; export nothing but finished foods; and trade those exports for gold and silver alone. Screw everyone else.

But I missed a core problem with American Mercantilism: its champions are 40 at oldest. They’re not in charge. The Mercantilists have climbed higher than their ages would suggest, but they at best report to the real people in charge: Wright, Burgum, Hegseth, Trump. I said in January that the Trump team is susceptible not only to normal blunders but also to corruption, infighting, turnover, leaks, vulgarity, partisanship, stupidity…and here we are, with links to each. Can anyone get things done working for these clowns?

The young, energetic Mercantilists can’t stop CENTCOM burning materiel. They can’t get the deficit under control. They got decent traction on AI, but…what else?

I had hope in January.

It’s gone now.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not reflect those of their current or previous employers or any elected officials. The author makes no recommendations toward any electric utility, regulatory body, or other organization. While certain information contained herein has been obtained from sources believed to be reliable, the author has not independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author assumes no liability for this information and no obligation to update the information or analysis contained herein in the future.

WTI and Henry Hub are the indexes I’m using for oil and gas prices, respectively—largely to align with these Texan energy companies.

As it turns out, what the EFFR is has changed since 2008. Trying to understand the transition from limited-reserves monetary policy to ample-reserves policy risks a Call of Cthulhu Sanity roll.

Granted, I had insider knowledge.

I dont think even if trump was to crown himself the fed chair would we get rates that low.

Trump loves using the stock market as the barometer of the economy and while wall street loves rate cuts they would spot a cut all the way down to 2.5 as a sign of either sever desperation or getting extremely drunk at the punch bowl.

Meanwhile there is point at which going to far with rate cuts runs counter to Bessent's goal at bringing down long term rates. If bond investors fear that inflation will really run up that high they will demand higher yields on long term debt.

I think Trumps part of the reason Trump attacks Powell is to use him as a scapegoat for the recession we are likely going into if not in already.