Capacity “Out of Thin Air” is Quite Hard

Dean Ball’s EO draft is quite good, but there are technical complications

Two Fridays ago, Dean W. Ball, fresh off a stint at the White House, returned to Hyperdimensional with a banger. In his recent post, “Out of Thin Air,” he proposed a valuable approach for improving electric grid capacity towards the development of AI infrastructure, complete with a draft Executive Order on demand response.

The draft EO proposes the interconnection category of Controllable Load Interconnection Services (CLIS). The CLIS structure would enable Large Flexible Loads (LFLs) (read: compute) to receive priority interconnection pathways conditional on meeting certain standards for curtailing load at the behest of broader grid conditions. Because grid generation fleets and transmission networks are sized (and financed) for the highest-load 100 hours of the year (and thus under-utilized for the other 8,660 hours of the year), LFLs that draw demand for hours except these high-load peak hours don’t require as meaningful a grid investment as the breathless thinkpieces and anti-AI YouTube video essays suggest.

In particular, the draft EO proposes measures like:

Establishing a “fast-lane” interconnection study track for LFLs: “If you can prove your ability to curtail load (based on a TBD metric), then you can interconnect faster.”

Authorize provisional interconnections: “You can interconnect now, but you’ll need to curtail load for 18 months while we build out infrastructure around you.”

Allow LFLs with on-site energy storage or generation to integrate as a single generation-plus-load interconnection node.

I have some nitpicks about definitions, and I think the draft EO could name-drop FERC Orders 2222 and 2023 for clarity. Redlines here:

But this is—in my estimation—a slam dunk. Great job, Dean.

The problem is that running demand response programs to pull electric capacity out of thin air is actually quite hard. I would know, because I’m trying to build such a program at my day job.

Problem 1: Commercial Buildings Are Crumbling Chimeras

Commercial buildings are deeply complicated electrical systems—lighting, HVAC (heating, ventilation, and air conditioning), process loads, subpanels, HVAC, backup generators, rooftop solar, and particularly HVAC. For these loads to run demand response, they must be wired to a building management system (BMS) that can coordinate digital fan controllers, HVAC compressors, lighting controllers, and so on from a “single pane of glass” dashboard on the facility manager’s computer screen. AI datacenters don’t have the most complicated electrical systems, but they’re up there, as this SemiAnalysis explainer demonstrates.

The problem is that these BMS tools degrade over time. Fan controllers burn out, sensors come loose, things get replaced, on-the-ground staff program hacks into their local thermostats, and building upgrades and extensions are half-installed in the BMS proper. Datacenters are new enough that they’re early into chimeric transformation, but a BMS can easily cost tens of thousands of dollars to install, much less maintain. Even connecting an extant BMS to utility controls can cost $10-20k. This isn’t crazy money for a datacenter, but it is a headache for the facilities manager.

However, datacenters are likely uniquely good at demand response. Normally, the loads attached to a commercial demand response program are lighting and HVAC. If the building has LEDs, then the lighting controls barely make a difference. And remember that peak load times for the electric grid are evenings in a heat wave and mornings in a cold snap. Do you want your HVAC to turn off during these times? By contrast, my understanding is that AI workloads, particularly inference and training, don’t require absolute 99.99% runtime, which would enable datacenters running such workloads to pause operation (and attendant HVAC operation) at the say-so of broader grid conditions…if the BMS can translate demand response signals from the electric utility into control signals for the internal building systems. Bold strategy, Cotton.

Problem 2: Telemetry and Baselining Are Not Exact Sciences

The $10,000/mo question is “How do you track and incentivize demand response?” And unfortunately, those questions are not settled. The typical structure of a commercial demand response event is:

<24 hours before the event: The utility identifies that tomorrow is likely a peak day. The utility informs the customer—sometimes via email, sometimes via phone call, less frequently via automated control signal. Yeah, not even the utility gets better notice than this. Blame the weather.

<12 hours before the event: The utility identifies the specific peak window, usually a 4-hour window like HE 18-HE 21.1 The utility informs the customer.

During the event: The customer curtails load. But not as much as load control software vendors promise.

After the event: The utility estimates the customer’s load curtailment based on output meter data.

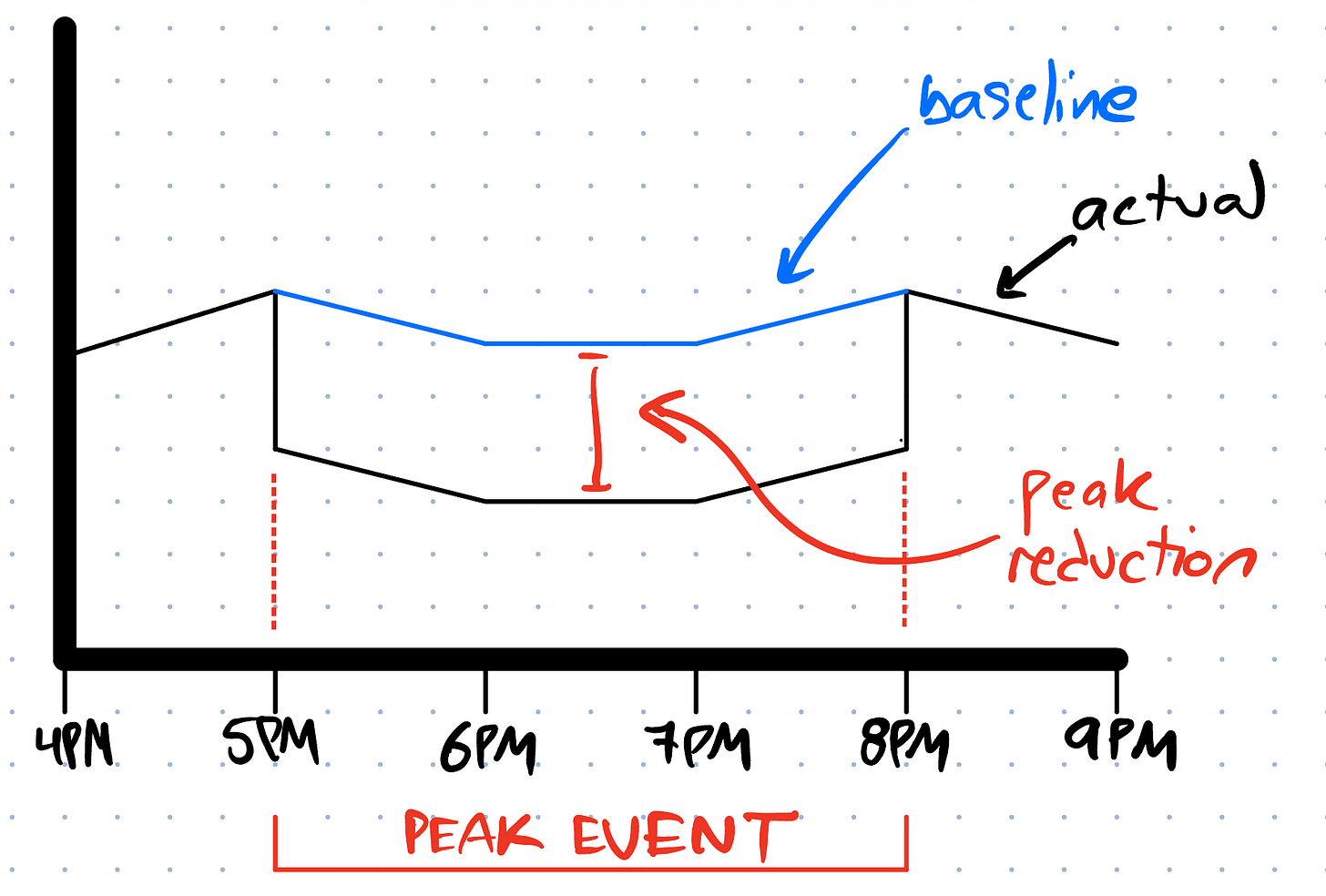

The operative word is estimate. The standard means of calculating the effect of demand response is to compare the actual meter data (typically hourly, hopefully 15-minute) during the peak event versus a “baseline” estimate of what the customer load would have been without the peak event.

There is, of course, no standard practice here. Some baseline calculations are rolling averages with weekends, holidays, and prior peak days redacted. Some baseline calculations fold in a correction for outdoor temperature, important for HVAC-driven loads. Some calculations are straight-up machine-learning algorithms, which are great until your local public utilities commission asks for an auditable formula.2 Oh, and meter data is often slow-to-update and prone to holes. If you want those problems fixed, you’re more than welcome to pay Itron extra money for a tech support staff who will actually return your phone calls, because “real customer service” is an optional extra.

Problem 3: The Incentives Are Fundamentally Small

There are three different metrics for electricity demand. All can be measured with the unit kilowatt-month (kW-mo), although these “equivalent” units are not interchangeable.

Non-coincident monthly demand: A customer’s maximum demand during a billing cycle month, regardless of when it is. If your shop mostly runs 100 kW of load all day, but your production machinery pulls a lights-dimming 300 kW on startup at 9AM every third Monday, then your utility will bill you at 300 kW. Sometimes, there’s an inter-month or seasonal ratchet in there, so if your startup process spikes to 500 kW on a hot day, surprise! Your utility might bill you at that 500 kW (or some abstruse fraction of 500 kW) for the rest of the summer, even if you shut down your entire line for July and August.3 For New England municipal electric utilities, the charge for non-coincident monthly demand is $10-20/kW-mo. Demand response programs are likely to worsen this charge as HVAC systems “rebound” after a peak event.

Coincident monthly transmission demand: The regional transmission grid’s maximum demand during a month, regardless of the specific utility service territory. Electric utilities—not customers—are charged based on their substation-metered electric demand at the registered peak hour for the month. The proceeds are divvied up to pay for transmission capex and opex. In New England, the timing of these transmission peaks is driven by the weather in Boston and New Haven, even for electric utilities in Maine, and ISO-NE typically does not confirm regional monthly transmission demand until the second week of the next month. Per the NEPOOL Transmission Committee, the monthly charge for transmission demand is $15.44/kW-mo for CY2025.

Coincident annual capacity demand: The regional transmission grid’s maximum demand for the entire year. Electric utilities are charged based on their substation-metered electric demand at the registered peak hour for the year. The proceeds are divvied up to pay for the capacity costs of the generation fleet, and in New England, the prices are set by capacity markets. That annual peak is usually set during a summer heat wave,4 so the system peak load for 2024 was only confirmed in October 2024. The demand figures each utility posted during that July evening determines the billed demand we pay from 1 June 2025 to 31 May 2026, at a rate of $2.531-2.639/kW-mo.5

Demand response incentives key off monthly transmission demand costs and maybe annual capacity demand costs paid by the utility. Remember that utilities must also pay internal software and staff costs to administer demand response programs, and that we cannot bank either on correctly predicting peaks or on customers curtailing load when we ask. For this reason, expect to see demand response incentives on the order of $5-8/kW-mo of load reduction, determined from meter data compared against a baseline, usually paid out two billing cycles after the fact, at the cost of 3-5 peak events called per month. At this incentive rate, a datacenter curtailing an impressive 10-15 MW of demand during peak events can expect to see a cost savings of $50-120k per month on their monthly electric bill.

The monthly electric bill for that 100MW datacenter is closer to $4-5M per month.

Problem 4: The Utility Toolsets for Demand Response Are Bad

I need to name some names.

Tangent Energy Solutions sells a demand response platform tailored towards grid-scale assets (peaker plants, MW-scale battery energy storage) and large load demand response platforms. Their secret sauce is that they staff their own North American control center for managing customer assets. Their AMP platform is a front-runner candidate for utilities seeking to implement demand response programs for AI datacenter loads.

And it’s not good.

I mean, it works, but it’s clunky. Forecasting tools are graphed in a way that looks Advanced™️ on screencaps but is hard to read and manipulate. Running peak dispatch events require opening up the switchboard from that Pixar short about alien abductors. Output telemetry is displayed in a manner so obtuse that you might as well export it to Excel and build your own PivotTable. And that telemetry doesn’t necessary talk to your billing system, meaning the data transfer is based on a flat file (read: CSV). The control room is pretty helpful for troubleshooting, though. At one gig, they provided a quote for replicating this service that would have cost $3-5/kW-mo on its own, before upfront costs and customer incentives.

These platforms suck. Tangent sucks, Itron sucks, I doubt Siemens or Schneider are any better, and all these vendors make big promises off vague buzzwords with mind-boggling SaaS fees. I stare at these glowing slide decks atop janky-looking screenshots, and I remind myself of the value chain: burn cash and serotonin to make these systems work, for an 80% chance (and falling) that we predict monthly peaks appropriately, for a 30-50% response (optimistically) from enrolled customers, to mail out incents that zero-out our internal benefit and barely rate on customers’ electric bills.

…Or I can post an RFP for a battery in my substation that will run on my command, at (mostly) promised output, every day if I like.

But It’s Different if the Alternative is No Interconnection

I need to clarify that none of these issues are the fault of Dean Ball nor something the White House can or needs to fix.

I’m at a tiny municipal electric utility, comparing large load demand response to a battery. If I’m at a utility with hundreds of thousands of customers, and the alternative to large load demand response is no large load, then the calculus shifts for both me and the customer. If the customer needs a Controllable Load Interconnection Service agreement simply to break ground, then the $5-8/kW-mo I would have spent on incentives can instead go towards transmission upgrades or a SaaS company’s accounts receivable. And if my counterfactual to large load demand response is losing the $20M/year account entirely (or facing a capacity shortage crisis), then the immense costs of implementing demand response with existing building management systems and utility software tools starts to pencil again.

Should our President sign this Executive Order, that revised calculus becomes a possibility.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not reflect those of their current or previous employers or any elected officials. The author makes no recommendations toward any electric utility, regulatory body, or other organization. While certain information contained herein has been obtained from sources believed to be reliable, the author has not independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author assumes no liability for this information and no obligation to update the information or analysis contained herein in the future.

Hour-ending 6 PM to hour-ending 9 PM = 5 PM to 9 PM. These peak windows were 3 hours in 2022 and will likely be 6-8 hours by 2030. If you’re installing a battery for peak-shaving your commercial building, spec for 4 hours minimum and consider 8 hours for future-proofing.

lmao do you think a utility regulator will take “the fundamental structure of a hybrid CNN-LSTM deep-learning neural network means that there is no inherent formula, only 500GB of training data on a cloud server in the Dulles Technology Corridor” for an answer?

This demand structure routinely bamboozles commercial customers, especially small business owners. Do we really want to make these rates even more complex?

for now

PJM and MISO price capacity in $/MW-day. The conversion ratio is $1/kW-mo = ~$33/MW-day.

It seems like what we really need is what I call 'dispstchable demand', or an energy heavy Industrial users who would get a big discount on their connection costs in exchange for them bidding in to the real time dispatch pool as if they were a generator, just with negative quantities.

They would have to have a fairly broad bid curve (price vs volume), that would cut most of their demand before OCGT and preferably CCGT marginal costs are reached. They might have to pre-commit to this curve to get the discount.

Given we dont really have these industrial users at scale yet, its a market that needs to be developed yet...